Increasing Financial Inclusion via Group Loans and Digitized Savings Records in Malawi and Uganda

In partnership with IPA and World Vision, researchers are conducting a randomized evaluation in Malawi and Uganda to measure whether group-based loans and digitized savings records for village savings and loans groups improve access to finance, use of finance, and group and individual well-being.

Although financial inclusion has increased worldwide, a significant share of individuals continue to face barriers, notably women, informal workers, and rural households.1 As a result, they tend to depend on savings and loans groups for funds to make investments. Evidence has found that group loans can increase borrowers’ access to finance and boost business outcomes, but impacts on food security and household spending are mixed,2 requiring further evaluation. Moreover, previous evidence suggests that digitizing financial services increases trust in, and subsequently usage of, the service.3 Can digitizing the records of savings groups—which increases accessibility in managing financial information—strengthen financial inclusion?

In partnership with IPA and World Vision, researchers are conducting a randomized evaluation in Malawi and Uganda to assess the impact of group-based loans and digitized records for village savings and loans groups. They will measure indicators including access to financial services, use of the financial services, and well-being at the group and individual level. The intervention involves 144 savings and loans groups in Malawi and 168 savings and loans groups in Uganda, who have been randomly assigned to the following arms:

- Group-based loan: Groups have access to a group-based loan product and participate in financial literacy training.

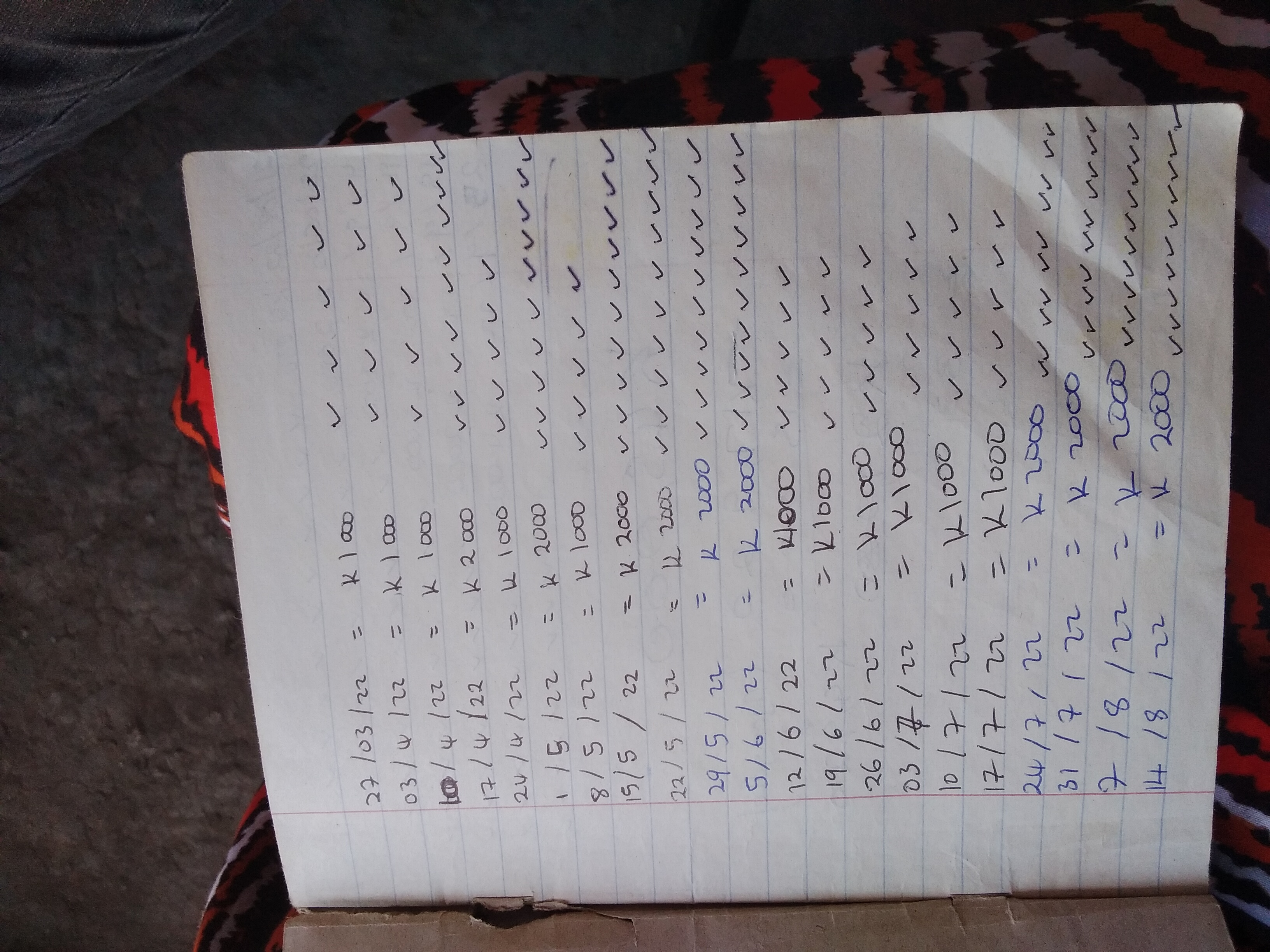

- Digitized savings: Groups have their savings records digitized.

- Combined: Groups have access to the group-based loan product and financial literacy training combined with having their savings records digitized.

- Comparison: Groups receive no intervention.

Results will be available in 2026.

Sources

1. Roy, Priyanka, and Binoti Patro. "Financial inclusion of women and gender gap in access to finance: A systematic literature review." Vision 26, no. 3 (2022): 282-299.

2.Attanasio, Orazio, Britta Augsburg, Ralph De Haas, Emla Fitzsimons, and Heike Harmgart. Group lending or individual lending? Evidence from a randomised field experiment in Mongolia. No. SP II 2014-303. WZB Discussion Paper, 2014.

Banerjee, Abhijit, Esther Duflo, Rachel Glennerster, and Cynthia Kinnan. "The miracle of microfinance? Evidence from a randomized evaluation." American economic journal: Applied economics 7, no. 1 (2015): 22-53.

3.Heath, Rachel, and Emma Riley. "Digital Financial Services and Women’s Empowerment: Experimental Evidence from Tanzania." (2024).

Implementing Partner