Unlocking the Potential of Savings Groups Through Group Loans and Digital Records: Insights from Our Baseline Survey in Uganda and Malawi

Mukasa, a young man from rural Uganda, joined a savings group hoping it would help him save to start a business selling charcoal and support his family. But on the day the group members were set to receive the funds they had saved, the group leader flipped through the group’s ledger book and delivered crushing news: Mukasa would not receive enough to start his business. Not because he hadn’t contributed enough, but because the ledger entries recording his contributions, along with those of other members, were missing or poorly recorded.

Saving groups are widely seen as a pathway for those without access to formal financial services, particularly in rural communities, to save money and access small loans that can support purchasing business and household assets. However, members often struggle to save enough individually and collectively to support one another. As a result, savings groups alone often fall short of meeting the full credit needs of their members. These groups also typically rely on paper ledgers that are prone to error, damage, and, as in Mukasa’s case, loss of transaction records.

To address these challenges, World Vision and its partners, including the microfinance organization VisionFund and FinTech company DreamStart Labs, are testing two interventions at scale:

- a loan product offered to savings groups as a whole, which members manage and repay collectively, and

- a smartphone application used to manage group records digitally, in place of paper ledgers.

World Vision is partnering with Innovations for Poverty Action to conduct a randomized evaluation in Uganda and Malawi to assess whether these interventions improve financial inclusion, livelihoods, women’s empowerment, and social cohesion outcomes. (For more, see the study description and AEA RCT registry). IPA’s recent evidence synthesis on savings groups highlights the promise of integrating such groups with formal financial institutions and digital platforms, though rigorous research in these areas remains limited.

This blog highlights key insights from a baseline survey conducted in July 2024, which offers valuable context for interpreting the evaluation results. The endline survey is planned for July 2026, with co-funding from BIGD’s Women’s Economic Empowerment and Digital Finance (WEE-DiFine) Research Initiative.

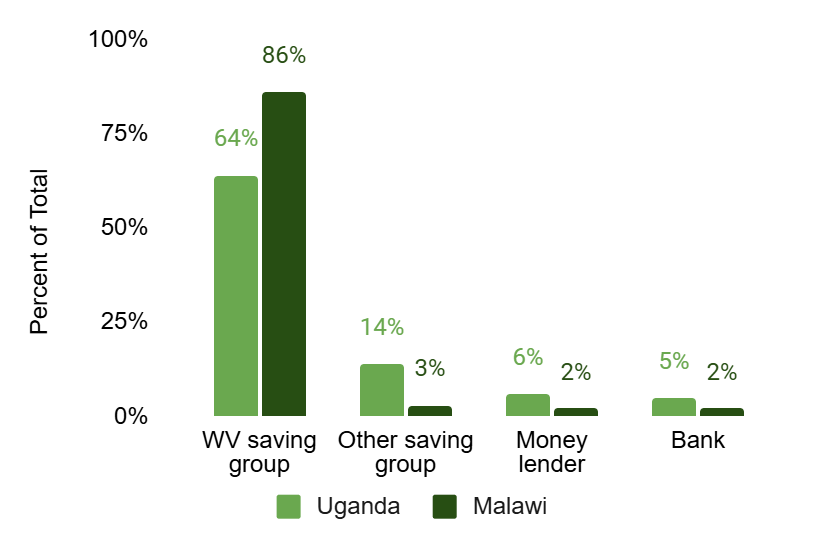

- Savings groups are the main source of credit for members, who take an average of two to three loans per year: Savings group members have a strong demand for credit. In Uganda, 64 percent of members used savings groups for credit, compared to 86 percent in Malawi. These loans were generally much smaller than those from other sources, roughly one-fifth the size of loans provided by banks or Savings and Credit Cooperatives (SACCOs).

Note: We excluded government and SACCO in the loan sources as these recorded 1 percent or below the total share of respondents in both countries.

- Food insecurity is a significant concern: At least two-thirds of participants in both countries reported relying on cheaper food for nine or more days in the past month due to financial constraints. About one in three participants ate fewer meals for at least one week in the past month. This underscores the role of credit not only in supporting long-term investments, but also in helping families maintain basic needs like food during times of financial stress. If food insecurity persists, it may also undermine participants’ overall nutrition and health, potentially limiting their ability to fully engage and benefit from the interventions.

- Basic phone ownership and mobile money access are widespread, but smartphone ownership is limited: In Uganda, 89 percent of participants own a personal phone, compared to 60 percent in Malawi. However, only 29 percent in Uganda and 20 percent in Malawi own smartphones, which limits the use of smartphone-based tools for managing savings groups records. Mobile money access is also widespread—91 percent in Uganda and 75 percent in Malawi–allowing members to receive funds digitally.

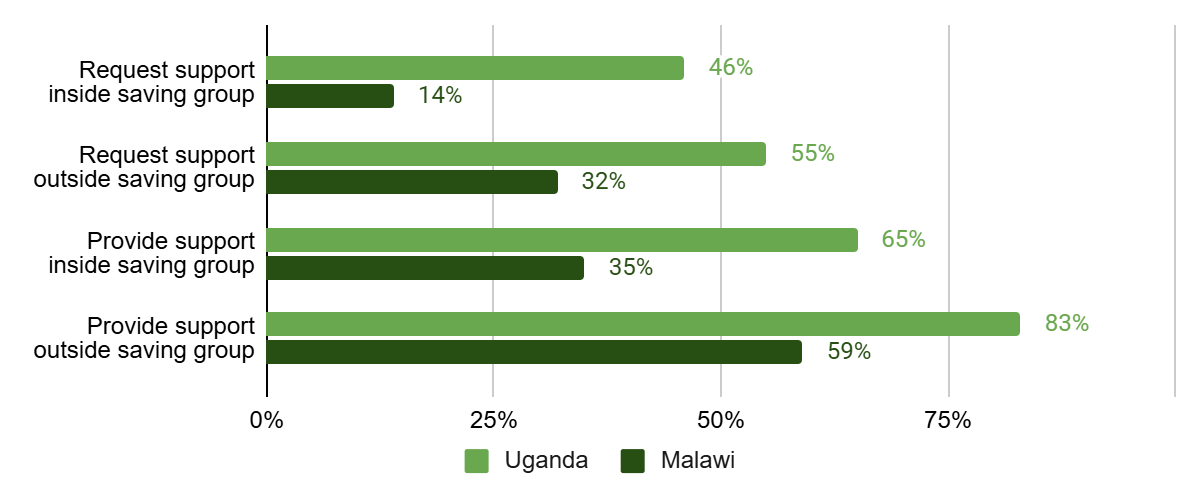

- Trust and social cohesion, which are key to savings group success, are high: Across both countries, about 95 percent of respondents said they trust their fellow group members. As shown in Figure 2, informal support, such as helping fellow members and even non-members is fairly common in Uganda. This high level of social cohesion creates a strong foundation for the effective implementation of both the credit and digital ledger interventions. However, as groups adopt digital tools, reduced face-to-face interaction could pose a risk to group cohesion. We will monitor and evaluate this potential impact in the endline survey.

These baseline results provide important benchmarks for key outcomes and offer valuable insights into the current context of savings groups. In the areas surveyed in Uganda and Malawi, savings groups continue to play a crucial role in promoting financial inclusion for vulnerable communities. While high levels of trust among members support the potential success of the interventions, challenges like food insecurity and limited access to smartphones may limit their impact.