From Research to Reality: Insights from Consumer Protection Workshops in Sub-Saharan Africa

When Jane*, a Ugandan mobile money customer, received a call that her phone line wasn’t registered and would be cut off if she didn’t share personal information, she immediately became concerned. She had a large balance on her mobile money account, and if her line was disconnected she could lose it all. Since the caller used Jane’s full name, she assumed the call was from an official Customer Care team. She decided to go to a nearby agent to help her fix the registration issue. But this agent was suspicious and spoke to the caller. It turns out the call was a scam and the agent prevented Jane from falling victim to fraud.

Unfortunately, not everyone will be as lucky as Jane. While the rise of digital financial services has improved financial inclusion globally, so have the methods used by scammers to target consumers like Jane. For instance, in Uganda, an Innovations for Poverty Action (IPA) survey found that 33 percent of mobile money users were targeted by a fraudster in the past six months. Uganda is not alone, as IPA surveys in Bangladesh, Kenya, and Nigeria confirmed fraud attempts are a major consumer risk in these markets as well. CGAP studies in West Africa seem to be pointing in the same direction.

This is exactly why, with the support of the Bill & Melinda Gates Foundation, IPA launched the Consumer Protection Research Initiative—to work with governments, financial institutions, and researchers to measure these risks, leverage novel digital data sources, and then test new ways to better protect consumers and support their financial health. This effort fits within IPA’s larger commitment to responsible financial inclusion. We see financial inclusion and consumer protection creating a virtuous circle to safely and securely allow people in low- and middle-income countries to make and receive payments, manage risk, and borrow and save money. Over the past three years, IPA has funded more than 20 consumer protection studies on fraud, redress, pricing transparency, and debt stress.

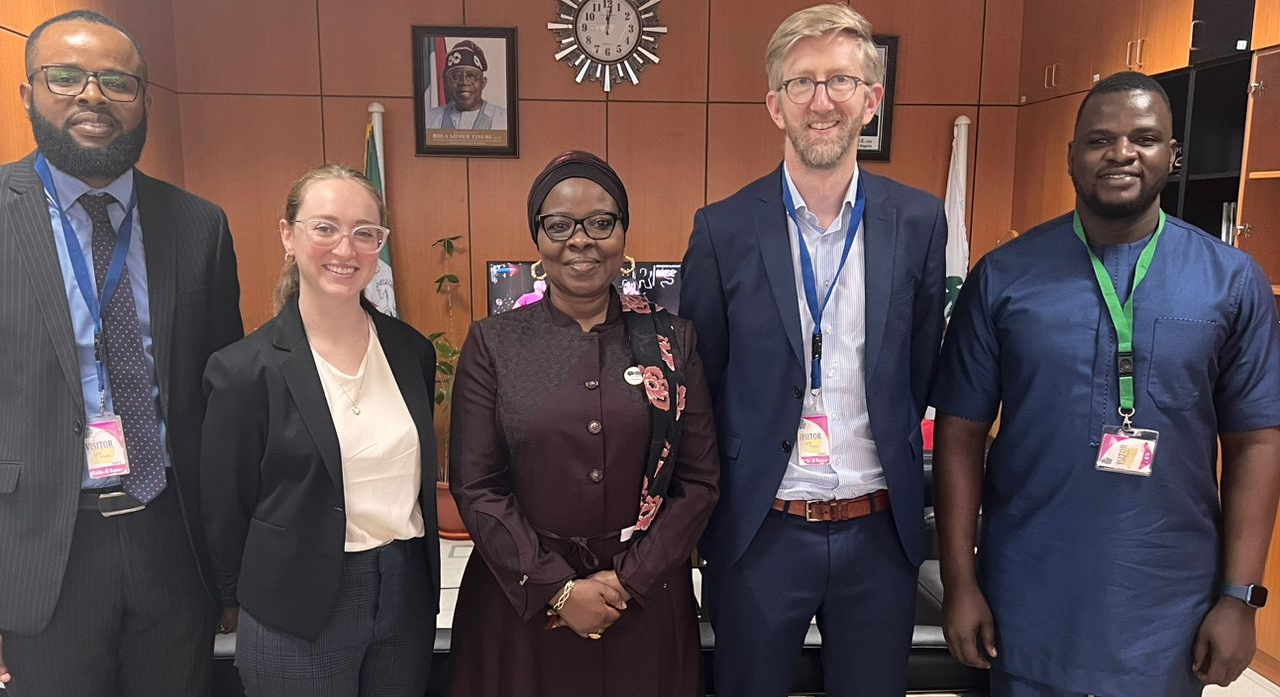

Throughout the first round of this initiative, we have worked closely with regulators, policymakers, and civil society organizations. But this past May was the first time we took our research on the road to Tanzania, Uganda, and Nigeria. Working with our teams in these countries, we hosted in-person workshops where we shared the wide-ranging package of consumer protection research methods and results from the initiative. We were joined by financial and telecom regulators, competition agencies, industry associations, local research agencies and academics, and consumer rights organizations.

To kick off the workshop, we gave a quick backgrounder on our research and what methods we’ve tested. From testing consumer protection education strategies to using customer complaints data to monitor consumer protection, IPA has utilized a broad range of methods to identify the most promising practices for protecting consumers. After this, we put our attendees’ collective experiences to the test. In smaller groups, attendees brainstormed what consumer protection risks are the most pressing in their country and how they could potentially resolve them with IPA’s research in mind.

While thousands of miles separate these countries, many of the risks and solutions were similar. For instance, attendees all highlighted fraud, high transaction costs, and poor complaint resolution as priority risks for consumers. In terms of solutions, increased transparency, more complaints channels, and increasing knowledge sharing between regulators were frequently mentioned. Some distinct differences between the countries also stood out. For instance, in Tanzania, attendees suggested tackling high transaction costs by conducting more research to understand the drivers of high costs. In Nigeria, attendees tapped into a hot topic—artificial intelligence (AI)—thinking about how AI and behavioral insights could be used to better understand consumer vulnerabilities. Overall, these discussions provided valuable insights as to how IPA’s existing research can address consumer protection risks and also new areas where we can test innovative methods.

So what’s next for the research initiative? We plan to keep on doing what we do best—bridging the gap between evidence and policy—by using new data and methods to better protect consumers and support their financial health. We’re hoping to continue and expand the program, developing new partnerships with regulators in new markets and diving deeper into new research tools that we can help regulators develop fair, safe, and equitable financial markets for everyone. If you have questions on how we do this or want to partner with us on research, whether you’re an academic, implementer, or funder, we want to hear from you. Together we can continue to encourage inclusive financial innovation while also protecting the interests of the most vulnerable consumers from fraud, debt distress, and high and hidden prices.

*The experiences described above are from interviews with Ugandans targeted by fraudsters as part of Bird and Mazer (2021) “Identifying Risk Factors Using Predictive Modeling for DigitalFinancial Services Fraud in Uganda.” The name of the respondent has been changed.