The Realities of Using Digital Financial Services in Nigeria

For Mary, a small market vendor in Kano, digital financial services (DFS) have been a game-changer. With just a few taps on her phone, she can pay her suppliers, send money to her family, and manage her savings without leaving her market stall. But beneath this convenience lies a set of risks that Nigerian DFS users face on a daily basis.

IPA recently completed the 2024 Nigeria Consumer Protection Survey—part of a broader set of surveys we will run during the second phase of IPA’s Consumer Protection Research Initiative. A comprehensive report about this survey has just been released: you can find it here. The 2024 survey, a follow-up to the 2020 Nigeria Consumer Protection Survey, took a deep dive into how Nigerians are using DFS, the challenges they face, and how they seek redress. The findings reveal a mixed picture: one of rapid growth, but also significant consumer protection challenges. Nearly one in four users reported experiencing unexpected fees or charges in the past year or being targeted by fraudsters. Among those experiencing issues, only half sought formal redress. Indebtedness concerns are also evident, with almost two out of every five digital credit users reporting they've been unable to repay a loan at some point.

Varying Adoption and some Concentrated Markets

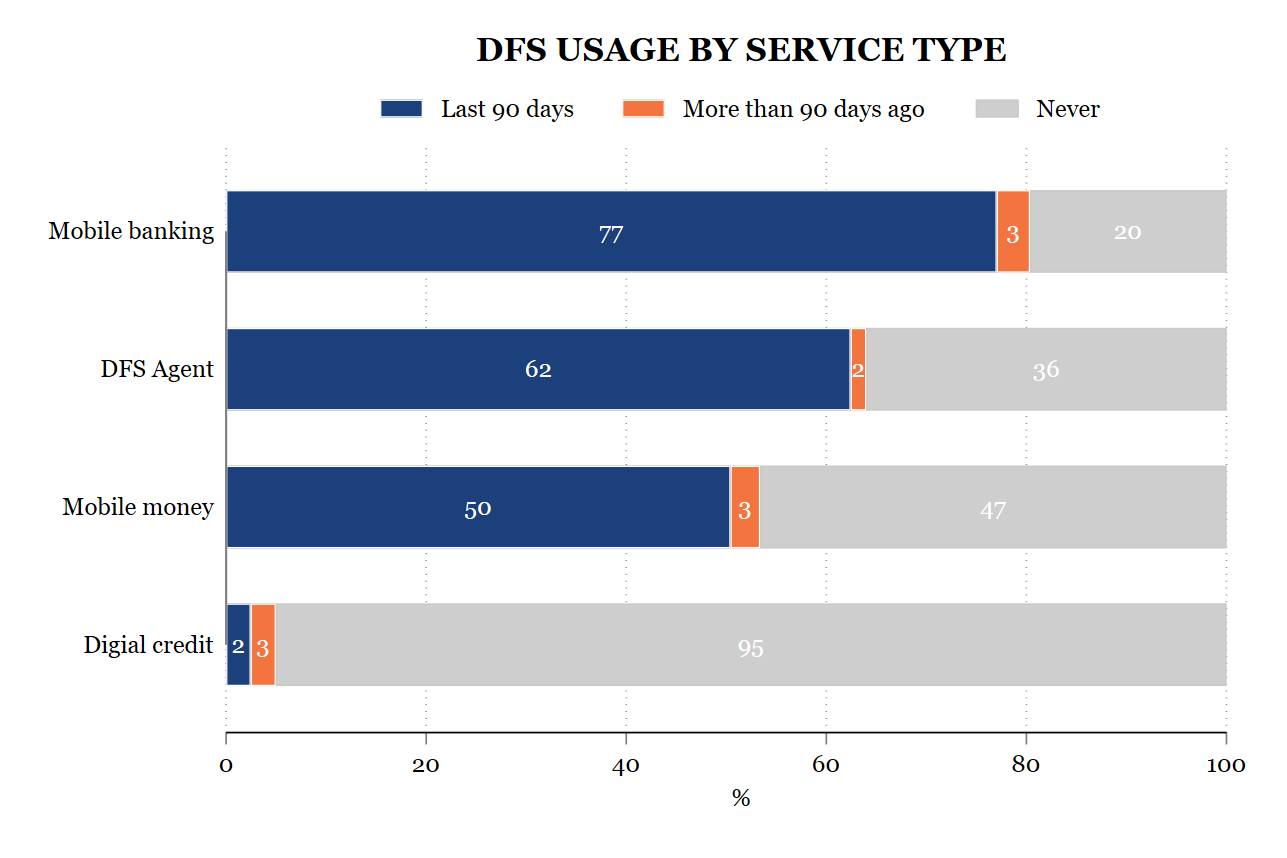

Nigerians display varying levels of DFS adoption. According to our survey, mobile banking is the most widely used service, with four out of five users accessing it within the last 90 days. Mobile money, used by just over half of respondents, is experiencing the fastest growth in the states we surveyed in 2020. In contrast to mobile banking and mobile money, digital credit—loans accessed by phone—remains relatively rare. Only 5 percent of DFS consumers have ever taken out a digital loan.

Digging deeper into the provider landscape, we see a mixture of concentration and competition. In the mobile money space, a single player—Opay (PayCom)—dominates the market, serving as the primary provider for a staggering 66 percent of the DFS users we surveyed. The mobile banking sector is more competitive. While no single bank dominates, we see providers such as Access Bank (22 percent) and United Bank for Africa (16 percent) carving out meaningful positions. This diversity likely benefits consumers through greater choice and healthy competitive dynamics.

What Drives Consumers' Choices?

So, how do Nigerian consumers choose their DFS providers? Trust, access, cost, and service quality emerge as the top factors. However, consumer behavior reveals a different pattern: Less than a third of consumers report checking fees before signing up for services, and only 17 percent have considered switching providers, suggesting significant obstacles to comparison shopping and provider mobility.

The Struggles of DFS Users

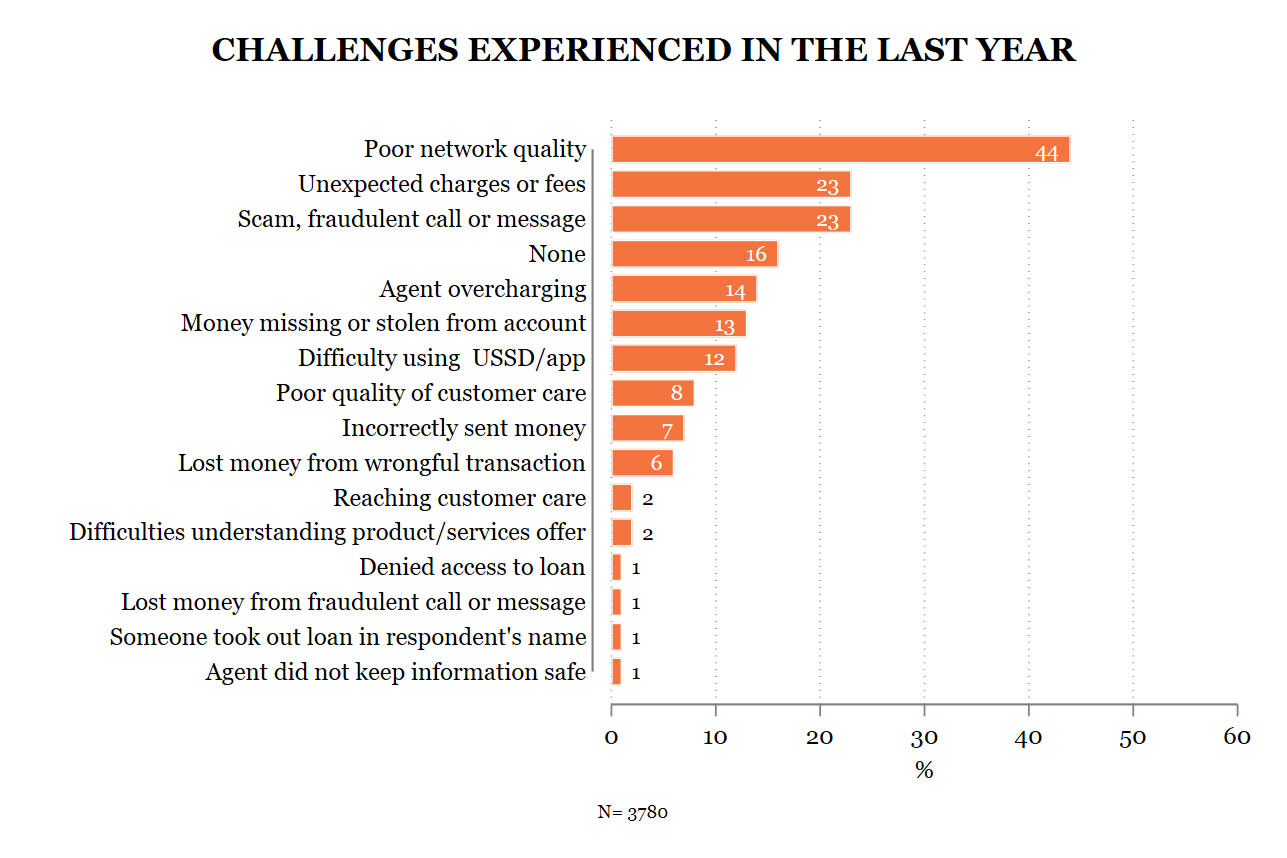

Our survey revealed that 84 percent of respondents encountered at least one issue while using DFS in the past year, and most blame these challenges on their providers. The most common problems? Network failures, unexpected fees—fees that were unclear or undisclosed at the time of the transaction—and fraud.

For vendors like Mary, unreliable networks disrupt their ability to process mobile payments, leaving them unpaid and their cash flow in disarray; losses they cannot afford. When forced to rely on cash, they face an increased risk of theft and lose the convenience of digital tools. Unexpected charges—even small ones—fraud, and unauthorized withdrawals create financial shortfalls and stressful disputes.

Perhaps Mary's alternative is to rely on financial services agents? Indeed, Nigeria's financial services agents remain very popular. But unfortunately, over a quarter of users report encountering problems when transacting with these agents. Lack of reliability and overcharging are the main culprits. Together, these challenges erode trust in digital financial services, jeopardizing the very tools designed to help these consumers and their businesses thrive.

Suffering in Silence: Are Consumers Seeking Redress?

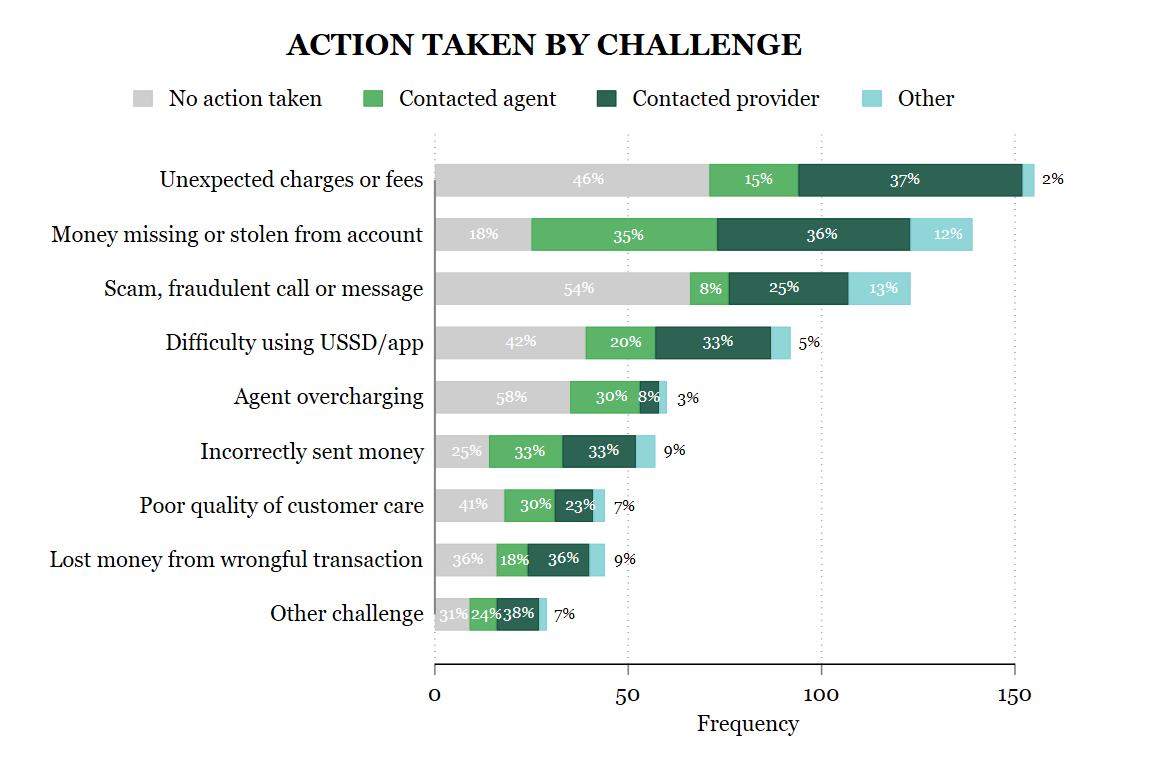

When Mary encounters an issue with her DFS provider, she may struggle to find a resolution. Like Mary, many consumers’ complaints about Nigeria's financial services go unresolved. Our survey found that a striking 54 percent of consumers took no action to address their largest challenge from the past year.

Sixty-one percent of those who do seek redress get their issue successfully addressed. However, the outlook is bleaker when the problem involves lost or stolen funds. In these cases (56 percent), consumers are less likely to get a satisfactory outcome. This lack of effective recourse takes a toll. When complaints are not resolved successfully, consumers say that they are more likely to reduce or even stop using the problematic service altogether.

What's Next for Consumer Protection in Nigeria?

Our findings point to a clear need for action. While DFS has undeniably improved financial access for many Nigerians, the system is far from perfect. With such a high number of consumers facing issues such as hidden fees, poor network quality, or fraud, it's clear that stronger protections are needed. Providers, regulators, policymakers, and all relevant stakeholders, must work together to improve transparency, enhance redress mechanisms, and strengthen fraud prevention measures. By doing so, we can ensure that digital financial services truly serve all Nigerians by making financial services easier, safer, and more affordable.