Encouraging Digital Merchant Payments through QR Codes: Results from a Rigorous Evaluation in Pakistan

Digital payment systems are expanding rapidly in Pakistan, but cash still dominates retail transactions. In 2024, only 4.3 percent of individuals paid a merchant digitally. This gap isn’t just about technology—it’s about trust, behavior, and incentives. Pakistan has over 4 million micro, small, and medium enterprises. Closing their access to finance gap of roughly USD 57 billion is a policy priority. Broader adoption of digital payments can help do just that.

To understand what’s holding back adoption—and what might shift it—IPA, researchers at the Lahore University of Management Sciences (LUMS), and a major mobile money provider in Pakistan partnered to conduct a rigorous research study. The focus: testing whether QR code payments could take hold in everyday retail transactions.

What we found reveals both promise and pitfalls—and offers insights for policymakers and providers looking to build a stronger digital payment ecosystem.

Understanding Barriers to Adoption

We conducted surveys with 816 retail merchants in Lahore, Islamabad and Rawalpindi between October and November 2023. Insights from these surveys point to an evolving ecosystem with prevailing challenges. Some of the learnings from these surveys are below.

- Merchants and consumers value digital payments, despite conducting transactions in cash: More than eighty percent of merchants in the sample agreed that digital payments could bring significant value to their business. However, merchants reported that, in the week prior to our survey, seventy five percent of customers paid with cash, sixteen percent used mobile money person-to-person (P2P) payments, fifteen percent used a payment card, twelve percent used the interbank funds transfer (IBFT) channel, and only five percent made a transaction via a QR code.

- Perceptions and preferences of both customers and merchants reinforce reliance on cash: Merchants cited that the primary reason for the continued reliance on cash is customer preferences. Forty-two percent of merchants said they do not accept digital payments because, as they believe, their customers prefer paying in cash. A complementary survey conducted in June 2024 with 150 customers of randomly selected merchants from our sample revealed a mirrored constraint: Eighteen percent stated that they do not pay digitally because, as they believe, the merchants they transact with prefer cash.

- Consumer protection concerns, such as fear of fraud and transaction failures, limit digital payment activity: Thirty-seven percent of merchants in our sample expressed fear of fraud around digital payments. Similarly, ten percent of customers cited a fear of being cheated by the merchant when paying digitally. Twenty three percent stated that their transactions do not always go through due to technical reasons

- Transaction arbitrage is high: About 45 percent of merchants said they had received requests from customers to make fake purchases, where customers had used the merchant to cash out funds stored digitally.

Testing what works: A randomized evaluation

To identify strategies that could shift behavior, we randomly assigned the 816 surveyed merchants—who already had QR codes but rarely used them—into four groups. Each group received a different intervention designed to encourage digital transactions:

- Group 1: Information only – Merchants received marketing and informational material about the benefits of accepting digital payments via a QR code for their business.

- Group 2: Merchant incentives – In addition to marketing and informational materials in group 1, merchants in group 2 received a cashback of PKR 200 for every transaction accepted by unique customers using a QR code (up to PKR 1000 per month).

- Group 3: Merchant and customer incentives – In addition to marketing and information materials and a cash back for merchants, this group also included customers who were incentivized to make digital payments. Customers in this group were invited to enter a lottery for a high-value smartphone.

- Group 4: Comparison (or Control) – This group consisted of merchants only and served as the comparison group. No incentives were provided to this group.

The interventions ran for three months. We tracked changes using administrative data, merchant surveys, and mystery shopping for the three months during the intervention campaign, and three months afterwards.

What changed—and what didn’t

The results are promising—but with caveats.

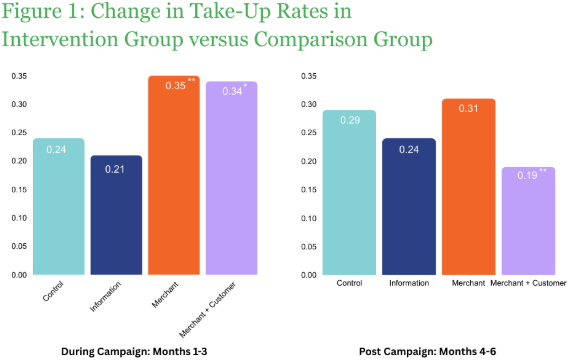

We learned that QR code use rose sharply in groups which had financial incentives. Group 2 (merchants incentives) saw a eleven percentage point increase in transaction count over the comparison group whereas Group 3 (merchant and customer incentives) saw a ten percentage point increase over the comparison group. Transaction values also increased substantially.

Note: Bars represent predicted take-up rates for each group from a regression controlling for baseline take-up and strata fixed effects. Values are calculated using post-estimation margins. *** p < 0.01, ** p < 0.05, * p < 0.1 indicate significance of difference from the control group (C). Source: Administrative data.

However, these effects disappeared once the campaign ended. QR usage fell back to baseline levels and there was no evidence of sustained adoption after incentives were removed.

Further analysis revealed that while usage returned to baseline levels, merchant perceptions shifted.. Merchants in Group 2 and 3 were less likely to believe that QR payments negatively affected revenue. They also reported higher average transaction values per customer (Across all transaction methods including cash).

On the other hand, providing information to merchants on the benefits of QR code use did not result in positive outcomes. This group saw a reduction in payment volumes through QR codes. In fact, merchants in this group were slightly more likely to worry about fraud and taxation.

What’s next: Tackling belief gaps with low-cost nudges

Our findings suggest that while financial incentives can boost QR code uptake temporarily, they are not enough to drive sustained behavior change. Usage returns to baseline levels once incentives are removed, raising important questions about long-term cost-effectiveness.

We do know, however, that merchants and customers both value digital payments, but put the onus of initiating the transition towards digital payment usage on each other. Solving this coordination challenge between the two sides of the market, in addition to addressing concerns around fraud and transaction failures can have lasting effects, moving Pakistan closer to inclusive financial access.