What Brazil’s Micro and Small Businesses Reveal About the Future of Digital Finance

Maria, owns a small bakery in Vitória, Espirito Santo. Five years ago, her business operated almost entirely in cash. Today, she simply holds up her phone as customers scan her QR code, instantly transferring funds through Brazil's revolutionary payment system, Pix.

Over the last five years, digital transactions have reshaped the way people and businesses in Brazil send and receive money and pay for goods and services. This transition has been facilitated by the introduction of the country’s instant payment system – Pix. Since launching in late 2020, Pix has processed billions of transactions, and is used by 76.4 percent of the population. While Pix has seen remarkable success in recent years, the key question now is how it can close the financial access gap for micro, small, and medium enterprises, especially micro and small businesses, and improve financial health outcomes for Brazilian businesses. Researchers from Bocconi University, the Central Bank of Brazil1, Insper, and Warwick Business School, in partnership with Innovations for Poverty Action (IPA), are conducting research in the Brazilian state of Espirito Santo to explore this question in depth.

The Context

MSME Landscape in Brazil

Brazil has a large micro, small, and medium enterprise (MSME) sector, with around 16 million businesses, making up 95% of all businesses in the country, but many still face major barriers to accessing finance. The MSME sector faces a financing gap of USD 593 billion, or 31 percent of the country’s GDP, one of the largest in the world outside of China, according to the IFC. Digital financial services (DFS), and especially the widespread use of Pix, offer a promising opportunity to expand access to formal finance. For example, Pix transaction data can be used to assess credit risk, helping lenders reach more businesses. Through Open finance, MSMEs—particularly micro and small enterprises—can securely share transaction and financial activity data with financial institutions, unlocking more tailored and accessible financial services

Pix and Open Finance in Brazil

Pix enables instantaneous transactions anytime for anyone with a linked bank account, at zero or low cost. At first, Pix was largely driven by transactions between personal bank accounts, but this has shifted over time. According to the Banco Central Do Brasil (BCB), by March 2025, 45 percent of transactions were between personal bank accounts— down from 62 percent in April 2023— while 55 percent involved a business bank account up from 38 percent in February 2023. As instant payment systems are key to enabling Open banking and Open finance, Brazil launched its Open finance protocol in 2021, which has since expanded to include a growing range of use cases.

What We Learned About Pix Use and Digital Financial Inclusion for Businesses

Pix Has Near-universal Reach but Business Account Usage is Still Low

Our survey with business owners revealed that Pix adoption is nearly universal— 96 percent of respondents use Pix for either business or personal reasons, and nearly half use it daily. While 64 percent of business owners have separate accounts for business and personal use, many still use both accounts for business transactions. Notably, 71 percent of those who use Pix for business report using a Pix key linked to their personal account for some of their business transactions.

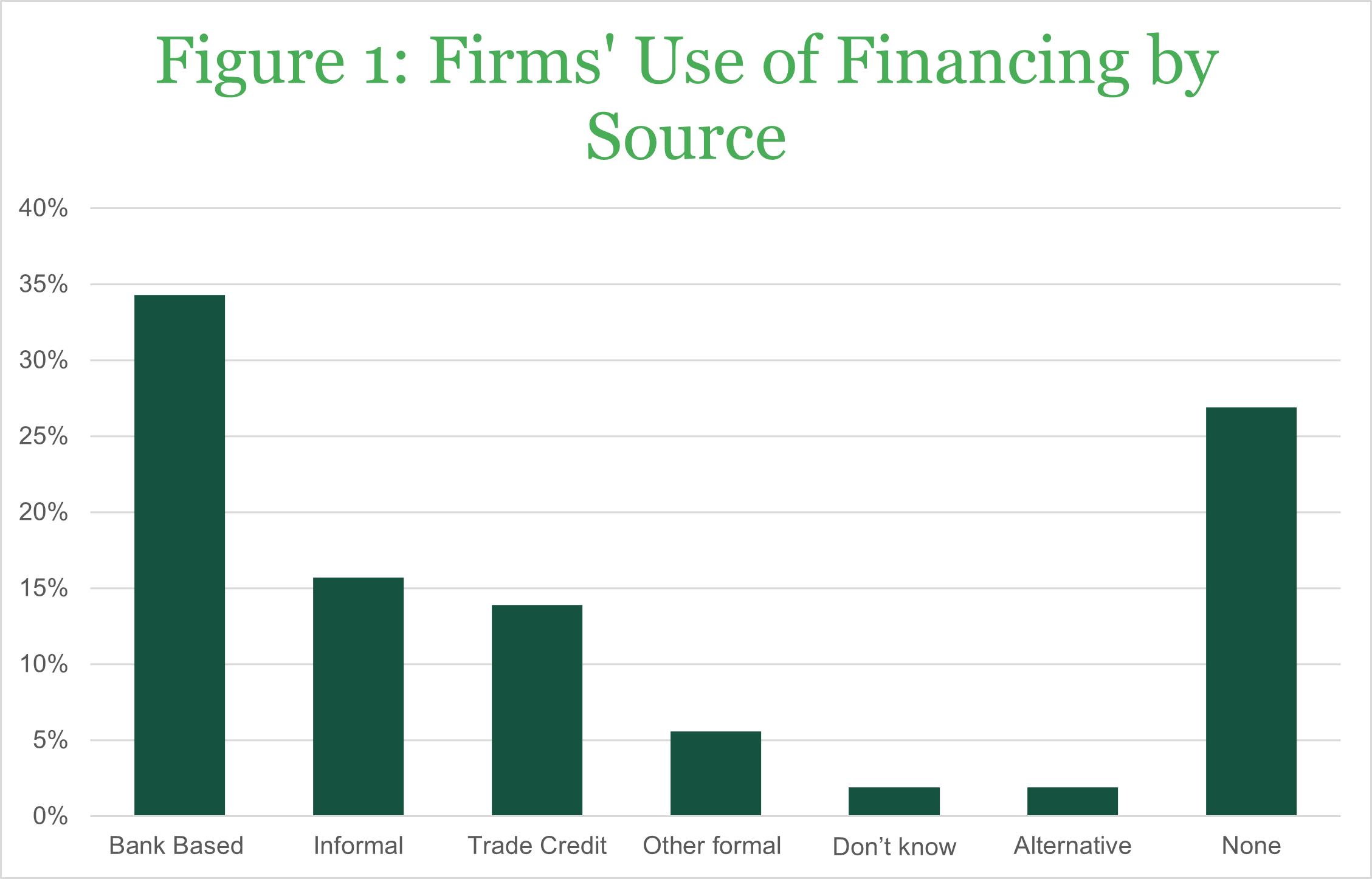

Banks Are a Financing Source, but Lending and Lack of Financing Remain Common

As shown in Figure 1, approximately 34 percent of businesses access some form of financing from a bank, whether through bank loan, credit cards, or overdraft facilities. However, informal sources like friends, family, or loan sharks are the second most common at 16 percent, while 27 percent of firms report having no financing at all. Among those whose bank loan applications were rejected, the most common reason cited was that their account was considered too new.

Awareness of Open Finance Remains Low

Only 15 percent of business owners in our sample had subscribed to Open finance, while 65 percent were unfamiliar with the concept. Similarly, 72 percent of owners reported that they trust their banks to securely manage their finances.

Entrepreneurs Use Digital Platforms for Business Operations

Beyond Pix, many entrepreneurs use digital tools for daily operations. For example, approximately 86 percent of respondents use WhatsApp to receive orders and 79 percent use it to place orders.

What We Are Doing: Early Insights

Our initial findings show that micro and small enterprise owners in Brazil are digitally and financially literate, with high adoption of Pix and other digital platforms. However, access to capital through banks remains limited. Open finance has the potential to bridge this gap by reducing information asymmetries between lenders and borrowers, resulting in appropriate product offerings at lower rates. But this requires a behavioral shift— micro and small enterprise owners must be comfortable sharing their transaction and financial activity data with financial institutions.

Our research aims to explore this challenge and will seek to answer three main questions:

- What firm characteristics are associated with higher adoption rates of Pix and Open finance?

- Does the incorporation of Pix transaction data improve credit scores and therefore improve credit outcomes for MSMEs?

- To what extent does educating firms on the advantages of Open finance influence their use of Pix and subsequently, their willingness to share financial data across providers?

Through this research, we aim to both aid policy making around Open finance by central banks while also bridging gaps in the academic literature around access to capital through digital financial services. Stay tuned!

1 The views expressed in this blog post are those of the authors and do not necessarily reflect those of the Banco Central do Brasil.