Unlocking the Potential of Competition: Insights from Ghana's Mobile Money Market

Mobile money markets are rapidly evolving, with new agents and products popping up every day. In Ghana alone, the number of active mobile money agents grew by 21 percent in 2023. GCB Bank, the largest and oldest bank in Ghana, recently launched an interoperable digital wallet service, G-Money. Interoperability, the ability of systems to connect and exchange information, is crucial for digital financial services. As mobile markets evolve, so should our research. Most research so far has focused on how digital financial services help with risk sharing and consumption smoothing—optimizing our standard of living by balancing spending and saving to manage obligations and unexpected expenses during different phases of life, especially when income fluctuates. However, there is limited research on how new agents affect the market structure, consumer demand, and trust. In addition, we know very little about how changes in the mobile money market impact non-financial goods and service sectors in the rural economy.

To address this we are collaborating with two mobile money service providers in Ghana to randomly onboard corner stores (that do not currently offer mobile money services) to offer G-Money and MTN Mobile Money. By conducting a census of current mobile money agents, surveying potential market entrants and consumers, and mystery shopping across 136 villages, we find four critical facts about the digital financial services market. While this research is still ongoing, here’s what our preliminary findings say:

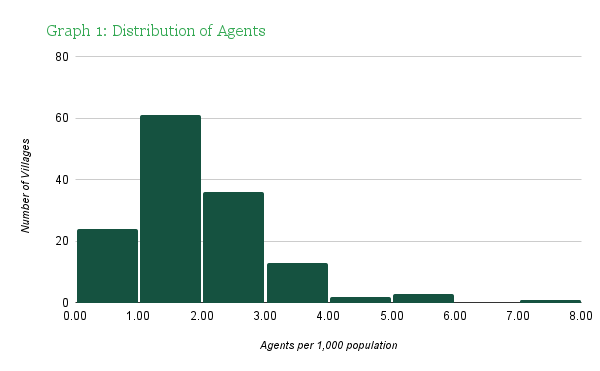

1. There is a direct relationship between the number of agents and the market size in a village. We find an unsurprising positive correlation between the number of agents and population size at the village level.

Nevertheless, there’s still significant variation in agent density across villages, suggesting there is room for new vendors. The majority of existing agents (77 percent) and potential entrant stores (98 percent) believe that the market can sustain new entrants. Therefore, there is an opportunity for market expansion without hurting existing operators.

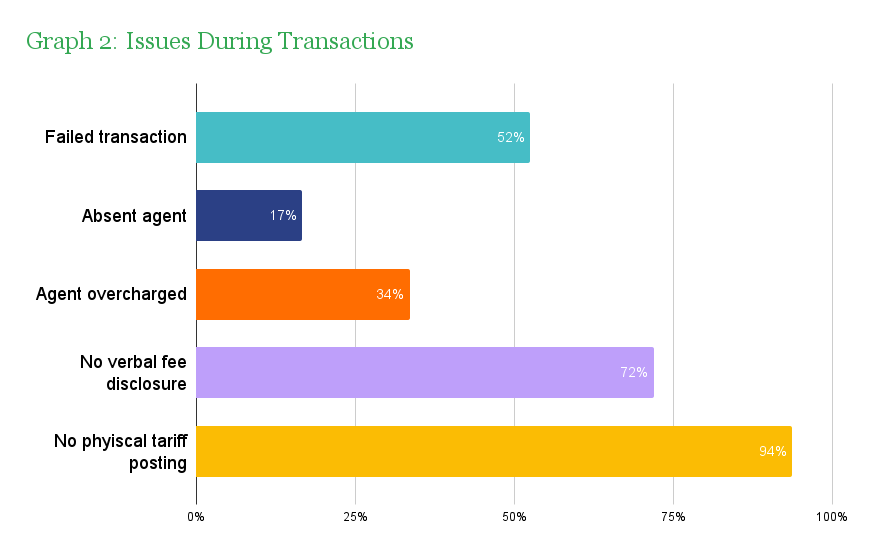

2. There are high rates of failed transactions, absent agents, and overcharging.

There is an alarming rate of failed transactions, missing agents, and overcharging that was uncovered through the audit study. This was compounded by a lack of price transparency, as only a small fraction of vendors disclose prices verbally or through physical tariff postings. These findings, echoed by consumer perceptions in our survey, highlight a critical concern over service quality and consumer protection within the market.

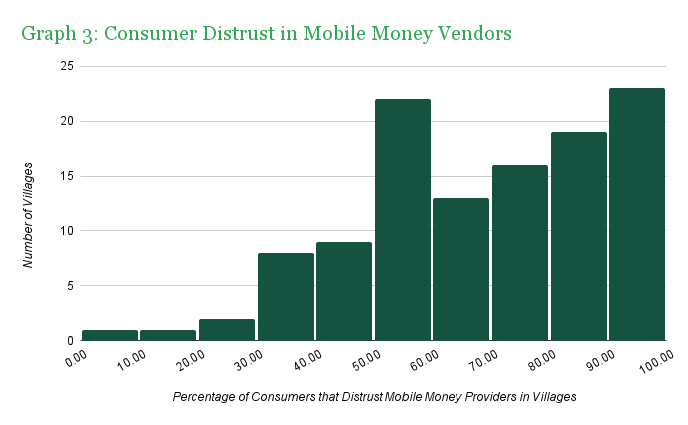

3. Many consumers do not trust mobile money vendors.

Our consumer survey reveals a significant variation in consumer trust in mobile money vendors and a large portion of consumers express mistrust. This is further supported by the low number of transactions per consumer within the past 90 days, indicating limited consumer trust overall. Poor service quality combined with a lack of trust may present a significant barrier to market growth.

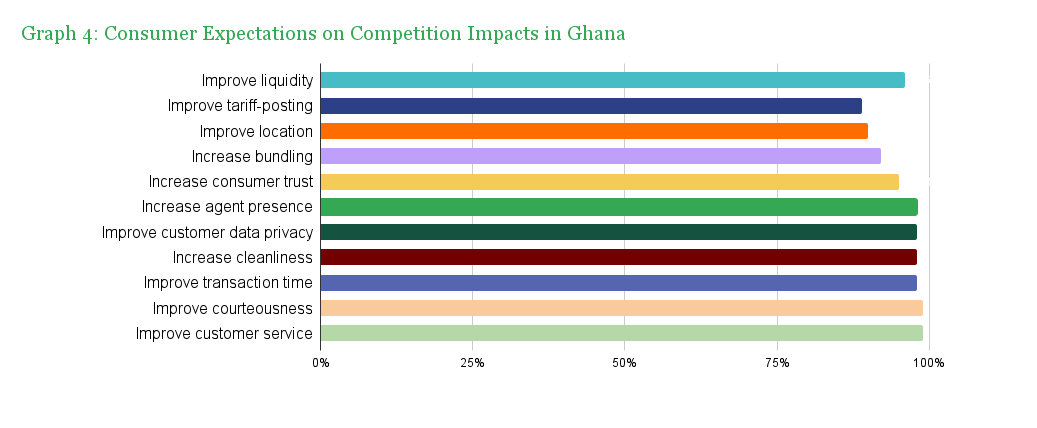

4. Consumers believe that new agents would have a positive impact on the mobile money market.

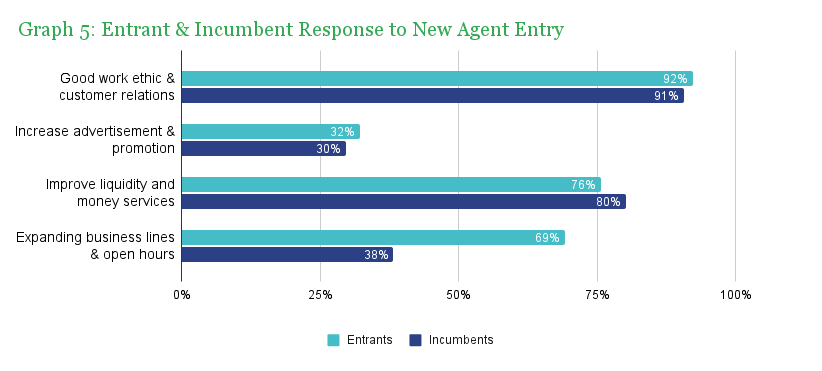

When we asked consumers what they thought would happen when new agents entered the market, they believed that factors such as quality, vendor misconduct, and trust would improve (see figure below). Consumers stated that they would expect less overcharging, liquidity improvements, better tariff-posting practices, and enhanced service quality. We also asked potential and existing agents what they would do if more agents opened up shop. Many seemed to be willing to put in the work to maintain their customer base, stating that they would improve customer service quality, transaction success, and availability. This highlights how new agents entering the market can drive competition, thus potentially improving service quality and consumer trust in DFS.

These market facts provide an interesting view of the DFS landscape, highlighting ample opportunities for market expansion. While consumers may not fully trust mobile money services at the moment, an influx of new agents may improve service quality, and in turn, consumer trust. As our study progresses, we hope to evaluate how these local markets will adjust as we randomly allocate some markets to get new agents. We will evaluate whether this increased competition increases important outcomes like consumer trust and vendor growth, as well as how it affects local economic activity.