Ugandan Mobile Money Customers Are Facing A Sudden Price Hike

A recent hike in fees for Airtel’s mobile money services in Uganda has caught many customers off guard. Price changes with limited accompanying notification to consumers, combined with minimal pricing disclosure by mobile money agents, as documented in IPA's Transaction Cost Index, can lead to unwelcome surprises to consumers and a breakdown in trust between financial service providers and their customers. A brief check at several agents in Kampala shows that none of the posted price lists reflect the new changes, and none of the agents we spot-checked were aware of the change in prices. Ultimately, this quiet shift will cause uncertainty and displeasure among mobile money customers surprised by the sudden increase in fees.

We have revised the Airtel Money sending and withdraw charges. Dial *185# or use the MyAirtel App; https://t.co/CdmAlsRTPC to enjoy the most affordable rates today. pic.twitter.com/oFXZ9I7Hfq

— Airtel Money Uganda (@airtelmoneyug) March 5, 2024

The announcement on X garnered more than 200 comments.

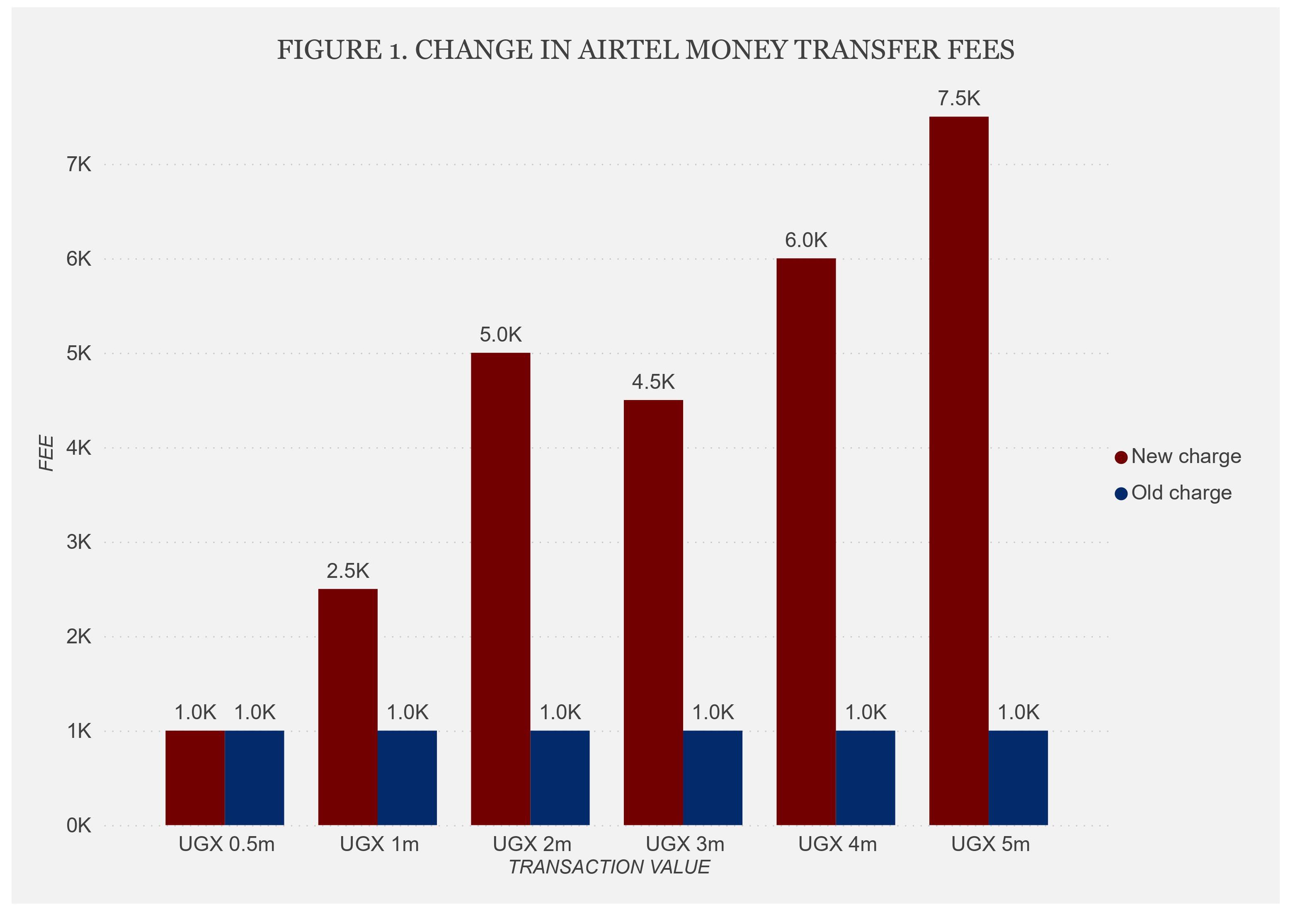

The changes introduced by Airtel Money include a partial shift away from a slab-based fee structure, where transaction amounts for withdrawals and account transfers within certain intervals are charged a flat fee (plus a tax on withdrawals). Before the change, amounts between 5,001 to 60,000 Ugandan shillings (UGX) could be sent to another person’s mobile money account for UGX 500. Anything above that was subject to a fixed 1,000-shilling fee. Transactions above 1 million Ugandan shillings (USD260) are now charged a percentage-based fee equal to between 0.15-0.25 percent of the transaction amount. As shown in Figure 1, this increases the fees customers pay by between 150 to 650 percent. A close inspection of Figure 1 also shows a quirk in the new price structure – it now costs less to transfer UGX 3 million than UGX 2 million. The new pricing also has an inconsistency depending on where you look: prices listed on Airtel’s website show that a 60,000 UGX transfer costs 1,000 shillings, while the price list posted on X shows a 500 UGX fee for the same transaction (as of March 25, 2024).

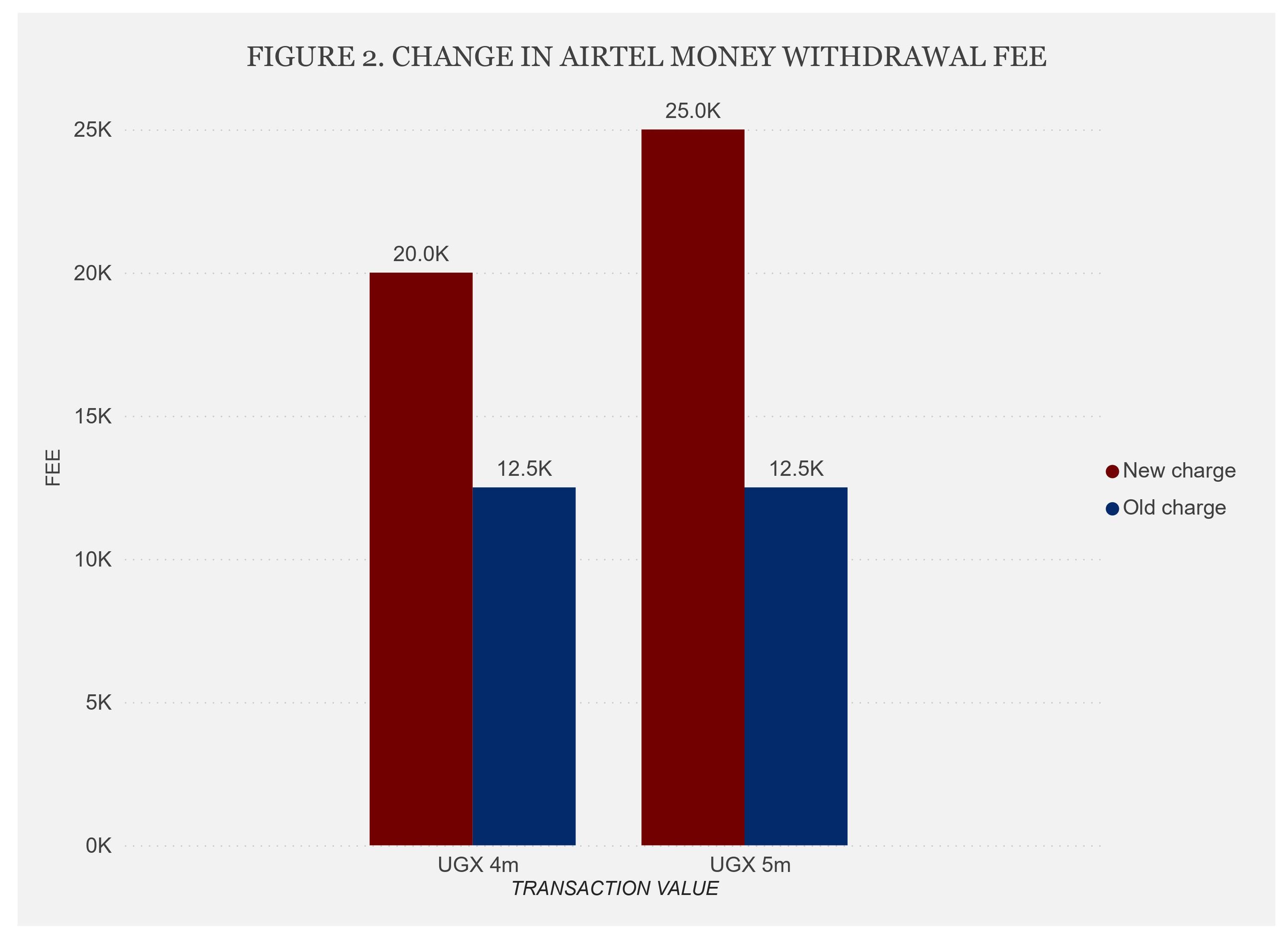

Moreover, agent withdrawal fees have also surged: withdrawals of 3 million shillings (USD 770) and above are now charged 0.5 percent of the transaction value, resulting in a 60-100 percent increase in the price (see Figure 2).

These changes impact a relatively small set of high-value transactions. Prices increased on transactions above 1 million shillings, whereas Transaction Cost Index data suggests the median mobile money transaction is approximately 20,000 shillings and just 2.5 percent of reported transactions are above 500,000 shillings.

Despite these substantial fee increases, consumers were largely uninformed, with notifications limited to an update on Airtel's website and a post on X announcing the changes in pricing lists. Information was not provided to consumers in any other way (such as a SMS notification). Many consumers only caught on to the price increase when they completed a transaction.

Failure to provide clear pricing information to consumers represents a critical consumer protection challenge, one that directly harms consumers and can lead to a breakdown in trust between consumers and their financial service providers. Ultimately this breakdown in trust can lead to reductions in usage. To help maintain trust with their customers, providers should aim to make such significant pricing changes less unexpected and ensure information regarding changes in fees is provided clearly and consistently.

Editor's note: Since the blog was posted, Airtel deleted the original post on X and updated the price list posted on X, correcting the discrepancy with the price list posted on their website. To provide further context, we have included links from local news outlets that reported on the recent changes in pricing on March 29, 2024 (Daily Monitor Uganda and NTV News Uganda).

Last revised: 04/08/2024 at 5:15 PM EST