Shifting Trends: The Decline of Women's Financial Account Ownership in the Philippines

The Philippines is a leading country in gender equality. In the latest Global Gender Report of the World Economic Forum, the country ranked 25th in gender parity globally and third in East and Southeast Asia. This remarkable performance was particularly prominent in the use of financial services, where women had consistently higher shares of account ownership and use than men according to the World Bank’s Global Findex. In practical terms, this meant that many women in the Philippines owned an account that allowed them to participate in the formal economy and access credit, insurance, and other financial services (Ashraf et. al, 2010; Dupas and Robinson, 2013; Cull et. al., 2014). That is something relatively rare among low- and middle-income countries. Women had been leading account ownership in the Philippines, until a shift in 2021.

Slow Growth in Women’s Accounts

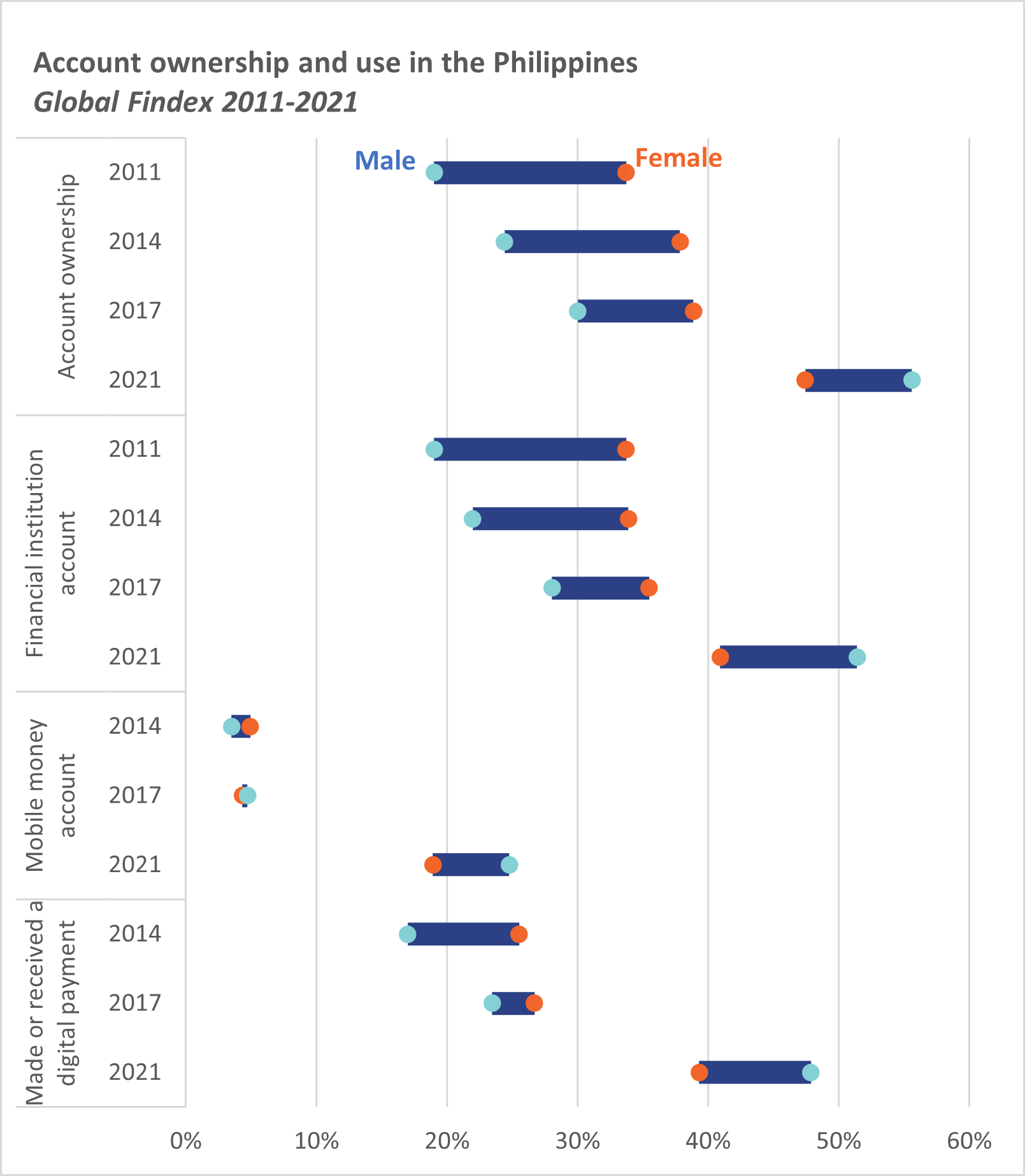

For the last decade, we have slowly seen the gender gap in women’s account ownership start to decline particularly since 2021. For the headline indicator on account ownership, the gender gap using the Global Findex reversed between 2011 and 2021. In 2011, women were 15 percentage points more likely than men to own either a financial institution account or a mobile money account. By 2021, this had reversed and men were 8 percentage points ahead. While account ownership has increased over the past decade for both women and men, men have seen much greater growth. From 2017 to 2021, the percentage of men with financial institution accounts rose by 23 points compared to 5 points for women. Similarly, the percentage of men with mobile money accounts increased by 20 points, whereas women saw a rise of 15 points. For mobile money in particular, the gap started to close in 2017, but by 2021, men began to outpace women as mobile money accounts more than quadrupled. Data on account use painted a similar picture, as more men have made or received a digital payment than their women counterparts in 2021, a reversal from 2017.

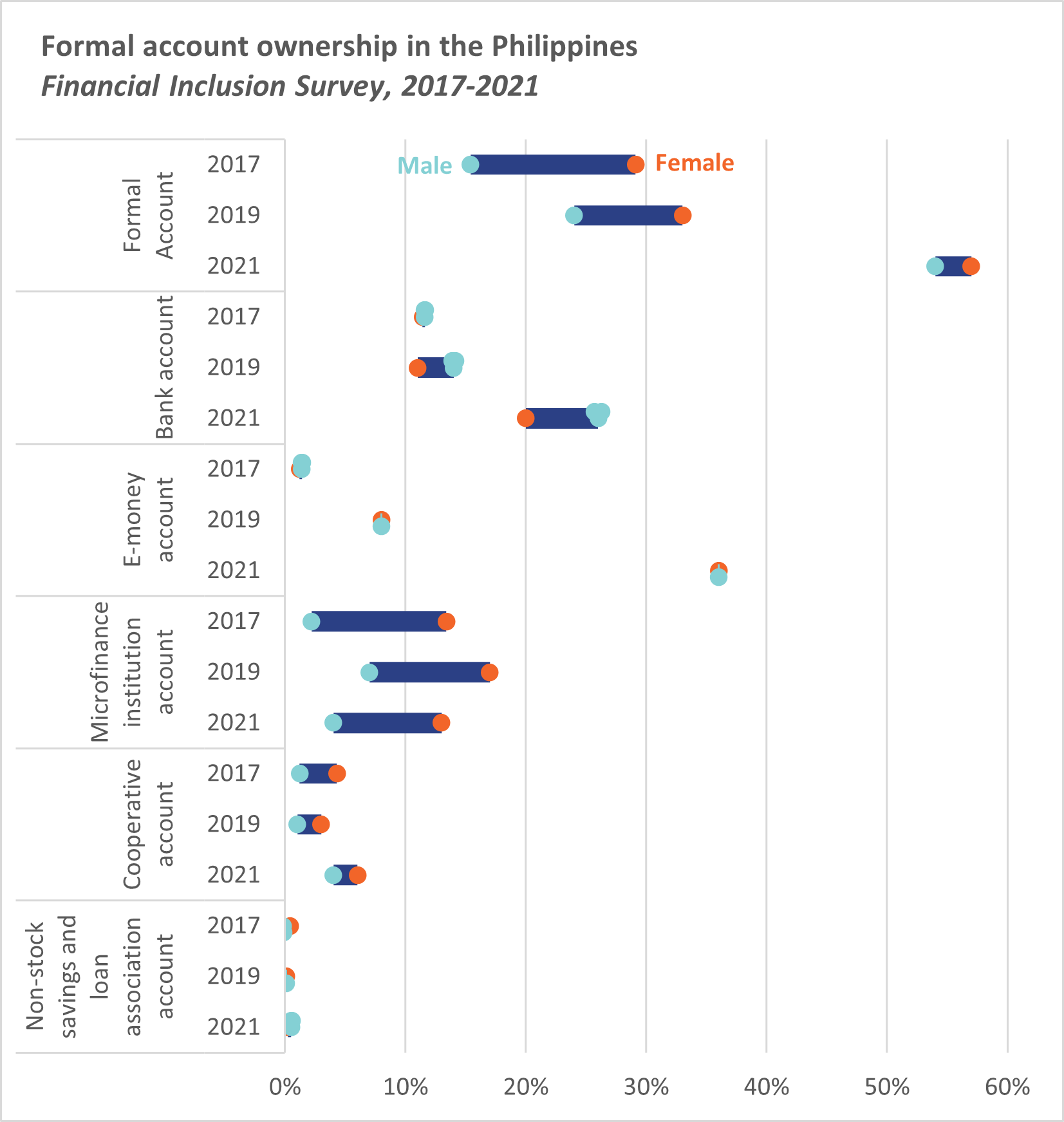

The 2021 Financial Inclusion Survey (FIS) from the Bangko Sentral ng Pilipinas did not show the same reversal in formal account ownership in its latest results, but it appeared to be heading in that direction. Women continued to post higher formal account ownership, though the gap narrowed from 14 percentage points in 2017 to 3 percentage points in 2021. By account category, women were 9 percentage points and 2 percentage points more likely than men to own microfinance accounts and cooperative accounts, respectively, while men were 6 percentage points more likely than women to own bank accounts in 2021. Notably, mobile money accounts, or mobile money, rapidly grew to be the top formal account type in 2021 with ownership consistently equal between men and women.

The Global Findex found that men were 6 percentage points more likely to own mobile money accounts than women, while the FIS consistently pointed to gender equality for the same indicator on mobile money accounts. Why? They are slightly different mainly because the Global Findex shows differences in active account ownership, whereas FIS focuses on ownership, regardless of usage.

The Promise of Mobile Money

Despite the differences, both surveys highlight the slow erosion of women's advantage in account ownership. Bank accounts, and most strikingly mobile money accounts, have grown rapidly, both of which tend to either have more usage by men or not have a significant gender gap. On the other hand, microfinance accounts, which were historically the most common account among women until 2021, have been slow to expand, according to data in the FIS. The data on saving behaviors confirmed this shift as consumers are moving away from putting savings in microfinance accounts (from 22 percent in 2019 to 13 percent in 2021) and toward bank accounts (from 21 percent in 2019 to 31 percent in 2021).

The emergence and rapid expansion of mobile money, which show narrower gender gaps, present an opportunity to make finance accessible for more women and advance gender equality more broadly. In the FIS, the top considerations for opening an account were the amount required to open (53 percent), maintaining balance (38 percent), and interest rate (38 percent), all of which standard mobile money services could address. Evidence has shown that implementing design tweaks that take into account the specific needs and preferences of women (IPA, 2017), including integrating mobile money into other financial services such as microfinance (Heath and Riley, 2024), would have positive impacts on women’s economic empowerment. In some ways, the Philippines is ahead of the curve relative to other low- and middle-income countries. For example, women have higher rates of mobile phone ownership and internet access (4 in 5 women in 2021), both critical demand-side factors for a range of financial services. The next question is how can financial service providers and other stakeholders leverage this advantage to offer better-suited products and services for women, and ensure that women do not fall even further behind in their use of formal digital financial services.