IPA’s Financial Inclusion Program New Research Agenda Investigates the Costs of Digital Financial Services in Tanzania

Innovations for Poverty Action (IPA) recently launched a new research agenda to investigate the costs of digital financial services (DFS) in Tanzania, called the Tanzania Affordable Digital Finance Research Initiative (TADFRI). Working with the Government of Tanzania and DFS providers, TADFRI will generate evidence on the drivers of the high cost of DFS to improve consumer welfare, ensure private sector sustainability, and enhance financial inclusion. In this blog, we explain why we’re pursuing this research agenda and how we will implement it.

Universal account ownership—we’re almost there, but why does cash still dominate?

Increasing adoption and usage of DFS has long been part of the global development agenda. DFS have a range of causal impacts on individuals’ financial health and resilience. The latest data from the World Bank’s Findex database shows that 76 percent of adults globally now have a formal financial account. However, despite getting closer to universal account ownership, cash still dominates many types of financial transactions, especially in low- and middle-income countries. For example, only 37 percent of adults in low- and middle-income countries paid for goods or services at a merchant using a digital channel. Only 16 percent made a utility payment using an account at a financial institution, and even fewer (eight percent) made a utility payment using a mobile phone (World Bank’s Findex database, 2021).

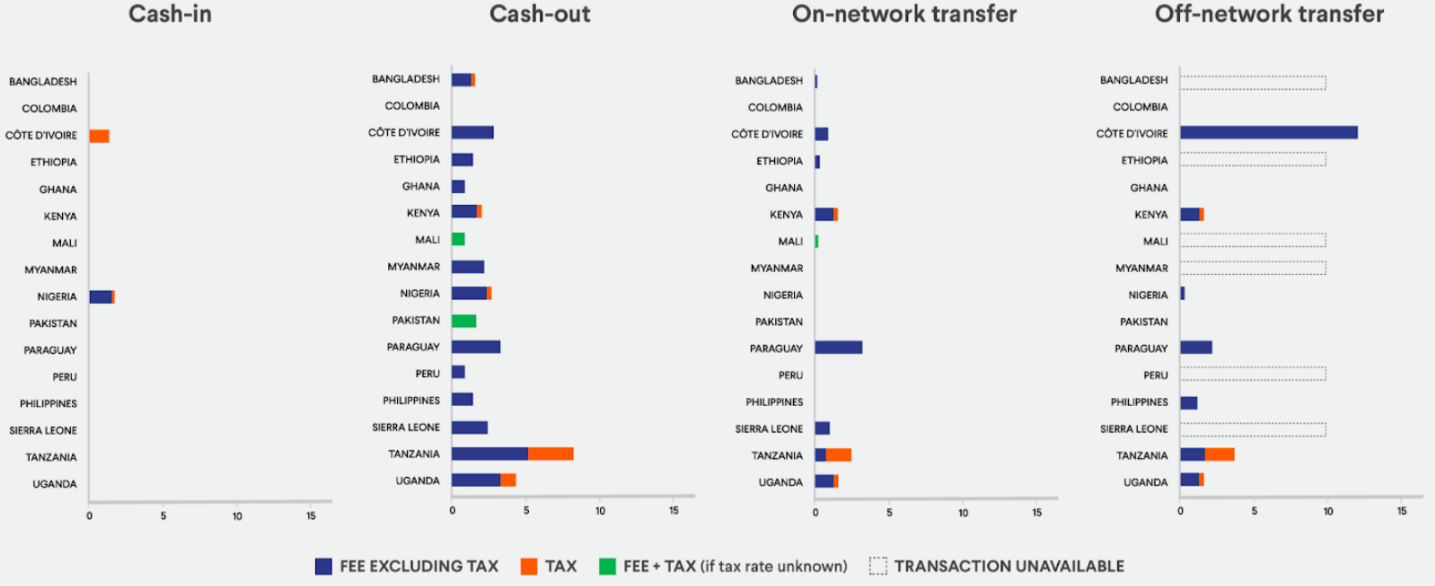

One reason people keep paying in cash might be that cash is free to use, while DFS often have fees. IPA’s Transaction Cost Index pulled pricing data from mobile money providers across 16 countries and found that sending money to another account with the same mobile money provider can cost up to 8.6 percent of the transaction value. Transfers to different providers and withdrawing cash from your account cost even more. Among these 16 countries, Tanzania emerged as one of the most expensive markets for DFS. See figure 1 below.

Figure 1: Fees by country by transaction type

Balancing consumer welfare, provider sustainability, and regulator objectives

Costs associated with DFS impose a significant burden on low-income consumers. Additionally, high costs can potentially reduce the adoption and usage of DFS by consumers for their daily needs which may erode the momentum toward universal account ownership and sustained usage.

To address affordability, we need to understand where the costs come from including the costs that all DFS providers face. Direct corporate taxation, compliance with regulatory mandates (such as Know Your Customer procedures), physical infrastructure such as bank branches, cell towers, and agent networks, and the cost of capital collectively impact pricing strategy. The state of competition in a market and the proliferation and adoption of payment system technologies can also influence pricing.

At the same time, the high costs of DFS and the potentially negative impact on financial inclusion and usage can impede government-level financial inclusion goals, especially in improving access for low-income consumers. Regulators face the unenviable task of balancing these impacts on consumer welfare and financial inclusion objectives against private sector sustainability when plotting their course of action. That’s where TADFRI can help, by providing robust evidence on a range of issues and developing a broad base of recommendations for DFS providers as well as regulators.

How is IPA implementing TADFRI?

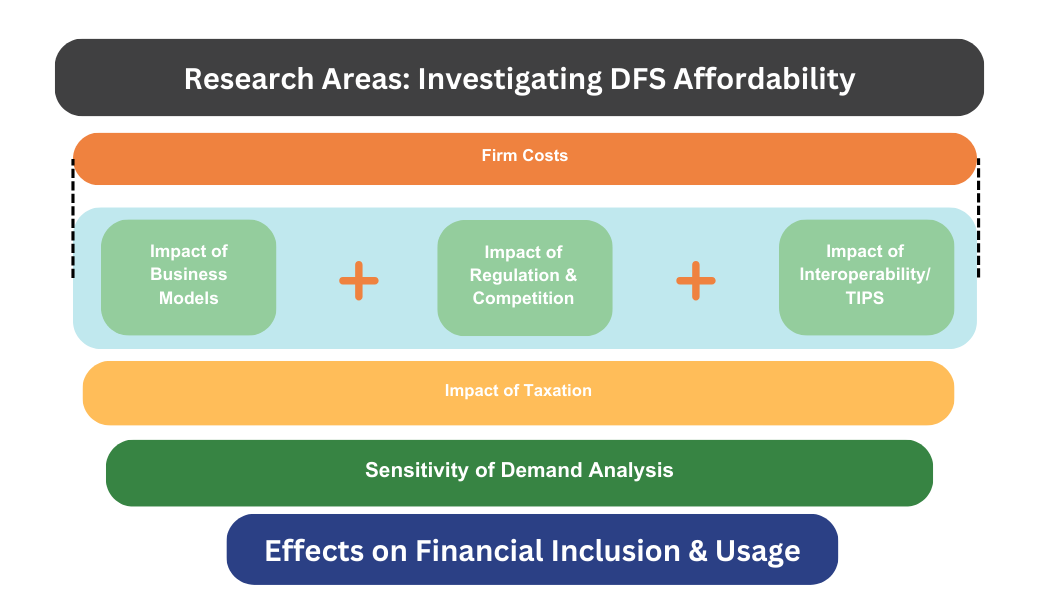

There are no easy policy solutions; improving affordability to achieve the respective goals of consumers, providers, and regulators requires a holistic approach. Under TADFRI, we will investigate the following five drivers that have the potential to influence the affordability of DFS in Tanzania.

Figure 2: Research Areas for Investigating DFS Affordability

Impact of Business Models: By studying different types of business models and the major cost and revenue centers we will determine the price breakdown for conventional services such as person-to-person transfers, cash out via mobile money agents, and person-to-merchant payments. This will inform methods to optimize prices by spreading costs across other products, such as insurance and credit. For this analysis, we will use the Accounts, Cash in Cash out, Transaction, and Adjacencies (ACTA) framework.

Impact of Regulation and Competition: We will examine the state of competition in the digital finance industry in Tanzania to see whether it is in fact driving innovation and reducing costs. Simultaneously, we will review relevant regulations to determine if and how these pressures add to the cost of operations for DFS providers and what regulatory instruments are available to promote affordability.

Impact of Tanzanian Instant Payment Systems (TIPS): Our team will evaluate how the introduction of the centralized TIPS is impacting operational costs of interoperability, which has previously existed through a web of bilateral integrations. We will also learn how TIPS can enable a wider proliferation of digital merchant payments by reducing market-level coordination inefficiencies. Additionally, we will explore how the resulting adoption and usage of digital merchant payments can contribute to cost optimization for providers.

Impact of Taxation: IPA will study the state of taxation for the digital finance industry and its current and historical impact on prices. We will help build a tax model to enable the creation of a more sustainable strategy.

Sensitivity of Demand Analysis: Finally, we will analyze how price changes affect individuals' usage of DFS, aiming to gauge consumer price sensitivity. Consumers might demonstrate 'elastic' behavior, significantly reducing their usage as prices increase, or 'inelastic' behavior, where their usage only slightly decreases with rising prices. This information will help us understand to what degree improving DFS affordability will advance financial inclusion and deepening goals.

IPA’s early engagements with regulators, government, and industry stakeholders in Tanzania have revealed that all five of these drivers are important contributors to affordability. Policymakers and DFS providers are keen to work together to create objective evidence that can help create more affordable DFS to achieve Tanzania’s broader financial inclusion goals. As we work with academics and digital finance experts to implement this research initiative, we will continue collaborating with policymakers and market players to ensure our research remains relevant and actionable. These conversations will inform our strategy so we may support Tanzania’s transition toward a more inclusive digital finance ecosystem.