Helping Borrowers Recover from Loan Default: Evidence from Digital Credit in Sub-Saharan Africa

Photo credit: © 2025 Ogundele Ayorinde / Shutterstock.com

Authors: Alfredo Burlando, Michael A. Kuhn, Silvia Prina, and Brock M. Wilson

Digital credit has revolutionized access to finance in low- and middle-income countries (LMICs). Borrowing is now faster and easier than ever before. Yet, the promise of instant, easy access lending is tempered by high default rates (Brailovskaya et al. 2024, Suri et al. 2021, Carlson 2018, Burlando et al. 2025) and the absence of enforcement mechanisms used by traditional banks. When borrowers fail to repay, lenders typically exclude them from future credit access. While this approach may deter intentional default, it also poses an important problem. Many borrowers default due to temporary financial shocks beyond their control, not strategic behavior. Excluding these borrowers means they lose access to valuable credit, and lenders lose potential future income streams. So how can digital lenders help borrowers with overdue loans regain access to credit?

We studied the effects of offering defaulting digital borrowers two light-touch programs aimed at increasing repayment of overdue digital loans: (1) a strategy to repay their overdue loan through a payment plan, and (2) renewed eligibility for future credit if they repay their current overdue loan.1

Setting and Study Design

We partnered with a digital lender in sub-Saharan Africa to conduct a randomized evaluation involving borrowers whose loans were 90-150 days overdue. We randomized these borrowers into four groups:

- Group 1: Borrowers were offered a plan breaking down a full repayment into four weekly installments;

- Group 2: Borrowers were notified that they will be eligible for a future loan if the delinquent loan is repaid;

- Group 3: Borrowers were offered both the repayment plan and the eligibility notice;

- Comparison group: Borrowers received weekly generic reminders encouraging them to repay their overdue loan.

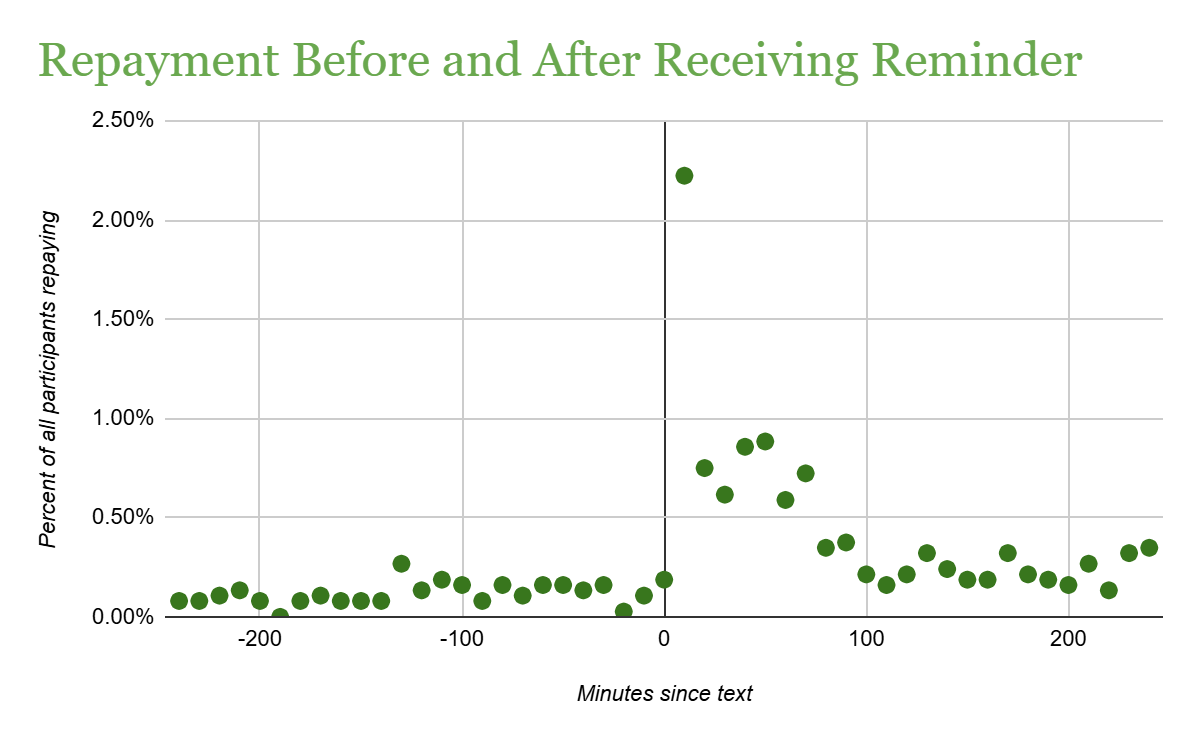

We also randomly selected an additional set of borrowers with overdue loans to observe without contacting them. This allowed us to measure the natural rate of repayment outside of the study and absent of communications. We refer to these borrowers as the “reference group” to distinguish them from the comparison group in the study. All participants across the four groups received notifications via text message. Each group received the same number of messages over the repayment period, sent on the same day and at the same time. Participants also received a new due date four weeks in the future. The only difference across groups was the message content, not the reminder effect.

Impacts on Repayment Behavior

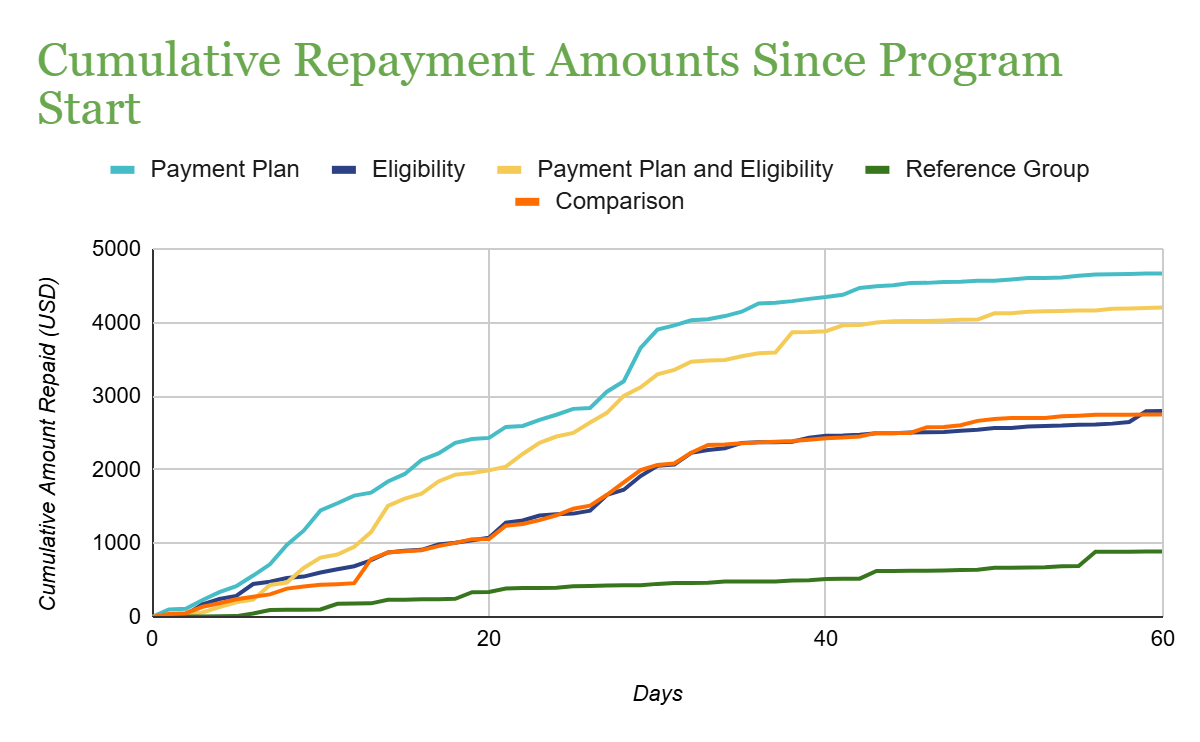

Repayment rates increased rapidly during the 30-day study period across all groups, compared to the reference group. Collections grew fastest in the first 30 days when participants received messages. Collections remained highest for borrowers in groups that included a repayment plan. The comparison group and eligibility group showed similar collection rates. While collections slow down after 30 days, they continue to accumulate for some time afterwards, with the accumulation rate being faster in the treatment arms with a repayment plan.

Offering repayment plans to overdue borrowers dramatically improved repayment rates. Borrowers became 57 percent more likely to make any payment at all—jumping from 16 percent in the comparison group to 25 percent with repayment plans. They were also 41 percent more likely to settle their debts completely during the program period. Combining a repayment plan with an eligibility notice has a similar, albeit slightly smaller, effect than a repayment plan alone. Messages informing borrowers that repayment would restore credit access proved ineffective on average.

Impacts on Borrower Rehabilitation

While only borrowers in the eligibility groups knew that repayment would restore their eligibility, eligibility was possible for all borrowers who repaid in full. Approximately 80 percent of those who repaid in full accepted a loan from the same lender. Furthermore, prior borrowers who took out these new loans repaid at a rate of around 80 percent in Group 1, suggesting that providing repayment options among long-term overdue borrowers has the potential to “rehabilitate” credit access. About 17 percent of the new loans are issued the same day borrowers repaid their previous loan, but the median wait is over a week.

Reminders Matter

Using the reference group’s repayment behavior, we find that reminders have a large positive effect on repayment. The repayment plan's total impact on settlement can be broken down into two components: the reminder effect accounts for at most 69 percent of the effect, while the repayment plan itself accounts for at least the remaining 31 percent.

Welfare Effects

While repayment plans did not increase borrower welfare beyond restoring credit access, eligibility notices may have negatively affected borrowers' stress and financial security. This may have occurred because the notices reminded borrowers that overdue loans prevented them from accessing future loans from our digital lender. Therefore, while text message reminders are a low-cost collection strategy for lenders, they can potentially harm borrower welfare if they highlight a lack of credit access.

Takeaways for Lenders and Policymakers

As lenders and policymakers seek new ways to improve repayment outcomes, our findings reveal that payment plans significantly improved repayment among borrowers with severely overdue loans, while eligibility reminders had limited effects and negatively affected borrower welfare.

This disconnect between behavioral and welfare impacts highlights the importance of measuring well-being outcomes in digital credit research. The study also demonstrates clear potential for low-cost interventions to help borrowers with overdue loans, as even basic reminders increased repayment substantially. While the absolute magnitudes of settlement remain small among borrowers in our study, other strategies could help more of this population recover credit access.

Future research should explore what interventions could reach additional borrower segments and determine the effective ceiling for re-establishing financial inclusion. Additionally, further work is needed to understand whether offering options to recover credit access reduces incentives for timely repayment and their long-term effects on borrower well-being.

1This study coincided with a policy change by the credit provider, shifting from permanently denying future loans to individuals with loans 90+ days overdue to reinstating eligibility all for those who repaid late loans. At the time, this change was not announced to borrowers—except those in Treatment 2—and at baseline, 59% of respondents believed late repayment would result in permanent exclusion from future borrowing