When a Crisis Hits, How Should Lenders Adapt?

In Kenya, like many economies, the COVID-19 pandemic disrupted lending activities, especially for microfinance institutions (MFIs). Public health restrictions in the country substantially affected economic activities, which resulted in job losses, reduced business incomes, and in some cases, the shutting down of businesses. Following their high reliance on steady repayments from microloans to cover their costs, which fell in the wake of the pandemic, MFIs were forced to institute coping mechanisms to ensure business continuity. MFI loan repayment data from our research shows that at the pandemic’s peak 36% of loan accounts were delinquent—meaning that repayments on loans were late—as compared to 9% of accounts before the pandemic. Even borrowers that had never missed a payment over several years of taking loans were delinquent during the pandemic. To cope with this, Kenyan lenders implemented different loan modification policies to help give their borrowers the best chance of avoiding delinquency. New research from IPA explores the question: in the wake of the COVID-19 pandemic in Kenya, which lender repayment policies were most effective at getting borrowers to repay their loans?

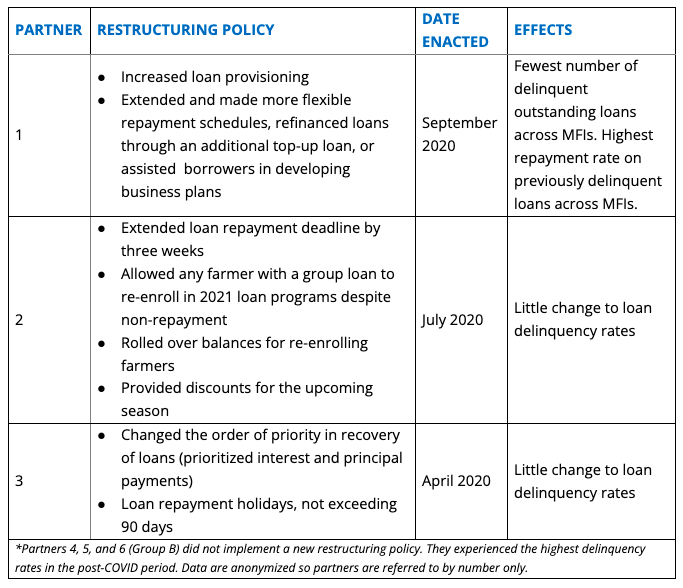

To answer this, we examined repayments for over 68,000 loans originating between January 2019 and August 2021 from six leading MFI lenders in Kenya through a collaboration with the crowdfunding microfinance non-profit, Kiva. Three of these lenders implemented restructuring policies in response to the COVID-19 pandemic (Group A, referred to individually as Partners 1-3); three did not (Group B, referred to individually as Partners 4-6). Table 1 summarizes the policies implemented and their impact on loan outcomes. Table 1 summarizes the policies implemented and their impact on loan outcomes.

Table 1. Restructuring Policy by MFI*

We then compared the changes in delinquency rates between MFI partners that did and did not implement loan restructuring. Before the start of the COVID-19 pandemic, we saw that there was already a difference in delinquency rates. Group A lenders (those that would eventually implement loan restructuring policies) had lower delinquency rates than Group B. This could be because Group A tended to lend to borrowers with better risk profiles.

Once the COVID-19 pandemic began, delinquency increased for both groups of lenders. However, for Group B, delinquency increased at an even higher rate than the delinquency rate for Group A. Before the pandemic, the difference in delinquency rates was 13.68 percentage points; after it was 25.5 percentage points. As seen in Figure 1, the difference in the delinquency rate gap roughly doubled between MFIs that did not implement new loan modification policies and those that did once the COVID-19 pandemic started. In addition to delinquency rates, the balance of these delinquent loans also increased after the pandemic, meaning consumers’ debt levels increased (see Figure 2).

Figure 1

Figure 2

As indicated in Table 1, Partner 1 saw the largest decrease in delinquency and the highest repayment rate once loan modification policies were implemented in 2020. Partner 1 launched a new recovery loan product for the pandemic which provided refinancing plans, whereas Partners 2 and 3 implemented a moratorium on loan repayments. Partner 1’s success suggests that tailoring approaches to the types of economic shocks may better counteract shocks than blanket policies like repayment suspension.

Unfortunately, we cannot observe in the data if a borrower received a loan modification and if so, what kind of modification they received. This is important data to collect, as prior research has shown that in the U.S. short-term decreases in monthly payments improve mortgage repayment while future interest write-downs improve credit card debt repayment. In addition, we cannot say that these repayment programs were the cause of the higher repayment rates (lower delinquency rates). Lower delinquency rates could be due to more proactive borrowers sorting into modification programs rather than the effects of the programs themselves. Future work, potentially through randomized evaluations, can help separate the effect of debt restructuring policies from borrower quality.

When low-income households experience shocks, credit flexibility ensures households can weather challenges like natural disasters, unexpected medical costs, or a global pandemic. We are still learning what types of modifications are most effective. Our results suggest that policies tailored to address the economic shocks induced by the COVID-19 pandemic in Kenya were most successful at both preventing delinquency and getting delinquent borrowers back on track to repayment. Learning from this, lenders should consider establishing channels that allow them to revise, tailor, and launch loan products in response to future systemic and individual economic challenges.