Skip to main content

Over at Yale, right around the corner from IPA, we recently sought to combat what PopTech calls “silos of excellence” – people in different fields working on the same problem from different perspectives, without communicating. At IPA, we work with behavioral economists, implementing partners, and policymakers to conduct research with the goal of evidence-based policymaking for poverty alleviation. But what would happen if we got these groups, and others thinking about financial security, such as ethnographers, product designers, and entrepreneurs – together in one room? Hosted by PopTech, Innovations for Poverty Action’s Global Financial Inclusion and US Household Finance initiatives, and American Express Serve,“Toward the Better Banked” (blogged about by PopTech here), enabled attendees to step out of their usual roles and leverage each other’s expertise to propose new questions, new approaches, and new innovations in building financial security around the world. As William Jack, Professor of Economics at Georgetown University aptly joked, “I’m not used to presenting to people who actually contribute to GDP, as opposed to those who measure whether it’s rising or falling.”

Throughout the day, we questioned the very definition of financial inclusion: Should our goal be "banking the underbanked" into our current system, or should we be focused on transforming the system itself? And where do our assumptions about the answers to these questions come from? Lisa Servon, Policy Professor at the New School who spent four months as a check casher at IPA partner RiteCheck in the Bronx, highlighted the ways in which alternative financial service providers meet a demand in low-income communities. For example, while consumers pay expensive premia to take money from their EBT accounts, Servon’s work highlights that they are willing to do so because they can get very specific small-dollar amounts at check cashers - you can’t take out $7 from an ATM. She also highlighted the human relationship component to check cashing that is missing from other forms of banking, raising questions about the best ways to bring service back into financial services.

Timothy Ogden, Managing Director of the Financial Access Initiative presented some early results from the US Financial Diaries project (a collaboration with the Center for Financial Services Innovation) which tracks the financial activity of over 200 low- and moderate-income families in the US. He stressed the need for obtaining a clear understanding of how low-income Americans live their lives. Ogden highlighted the problems that can come from volatility in income which can make managing finances much harder. The presentation encouraged us to think about how to help "underbanked" households manage not just low incomes, but unpredictable ones. Results of the US Financial Diaries project are forthcoming; one key, surmountable challenge is to calibrate these numbers so that we can use this rich data to make predictions about behavior of American households at large.

We questioned what financial inclusion means in the digital age, and how the definition of financial inclusion is shaped by the rapidly evolving technological landscape. Naturally, this means factoring in the influence of Big Data, technological innovation, and mobile platforms. In thinking about Big Data, product designers, researchers, and companies discussed how to help people make better choices without invading their privacy. We also heard from financial technology innovators, such as Francisco Cervera of startup eMoneyPool, an online platform that challenges the idea that “money pools” – savings circles in which individuals pool money for payouts to one group member each month - need to be informal, geographically constrained, or only between family and friends.

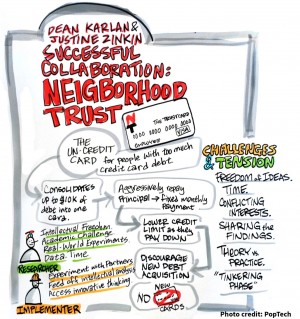

After thinking critically about current approaches, we asked "Where do we go from here?” and what the takeaways are for product development, product testing, and research collaboration. IPA founder and President Dean Karlan and Justine Zinkin of Neighborhood Trust helped the group see the many ways in which researchers and practitioners have aligned incentives. They noted that differences on intellectual freedom can be a key obstacle for research-practitioner partnerships to overcome, but highlighted their own successful collaboration. They discussed projects like the Trust Card, which consolidates debt and incorporates behavioral features like fixed monthly payments and a declining credit limit. Steve Wendel of HelloWallet challenged the idea that behavioral economics is the only input needed for behaviorally informed product development, stressing that design thinking has a key role to play in making sure behaviorally informed products are seen and adopted. Both Karlan and Wendel made the case for a phase prior to randomized controlled trials, during which multiple designs are prototyped and iteratively improved. Academic Director of IPA’s US Household Finance Initiative and economics professor at Dartmouth, Jonathan Zinman, discussed a specific space for innovation: fee-for-service liability management. Zinman proposed that ‘liability managers’ could offer services designed to minimize borrowing costs of overindebted Americans paying too much for their loans – in the same way that asset managers maximize risk-adjusted returns. While the right business model is still to be determined, Zinman highlighted the importance of using insights from behavioral economics to unlock consumer willingness-to-pay for these potentially highly valuable services.

Perhaps our goal should be simply to “bank the underbanked.” But PopTech gave us an opportunity to focus on more fundamental questions around consumer behavior and what financial security means in today’s world. It is clear that disruptive innovation will be necessary to increase financial security for the “underbanked.” Behavioral economic research will play a key role in both generating thoughtful innovations and rigorously evaluating those innovations to ensure that they are having the impact we hope they will have on people’s financial lives around the world. And continued dialogue with actors from all fields and sectors will mean we are asking smarter questions and developing and testing stronger solutions.

Anna Cash is a Project Associate for IPA's US Household Finance Initiative, Pooja Wagh is a Project Coordinator for IPA's Global Financial Inclusion Initiative.

October 09, 2013