Nine Million US Households Choose to be Unbanked: Do We Understand Their Financial Health?

If buying a $20 subway fare card with a debit card can result in ten unexpected overdraft fees for $358, why would you choose using a checking account at all? For many consumers, there are important benefits and a perfectly rational logic to not taking part in a formal financial system. According to the FDIC’s most recent National Survey of Unbanked and Underbanked Household, almost 20% of Americans are underbanked, meaning that they hold an account at an insured institution but also use financial products outside of the banking system.

There is an argument that these consumers are losing out on opportunities to engage in a wider range of financial practices – such as savings – by doing business with nonbank institutions which can’t offer deposit accounts, for example. Financial wellness efforts in the United States have traditionally focused on banking access and formal savings accumulation, even while large swaths of consumers continue to work outside of the formal banking system. But what if financial wellbeing advocates adopted a more holistic approach to financial wellness and found ways to support healthy financial habits outside of the traditional banking world?

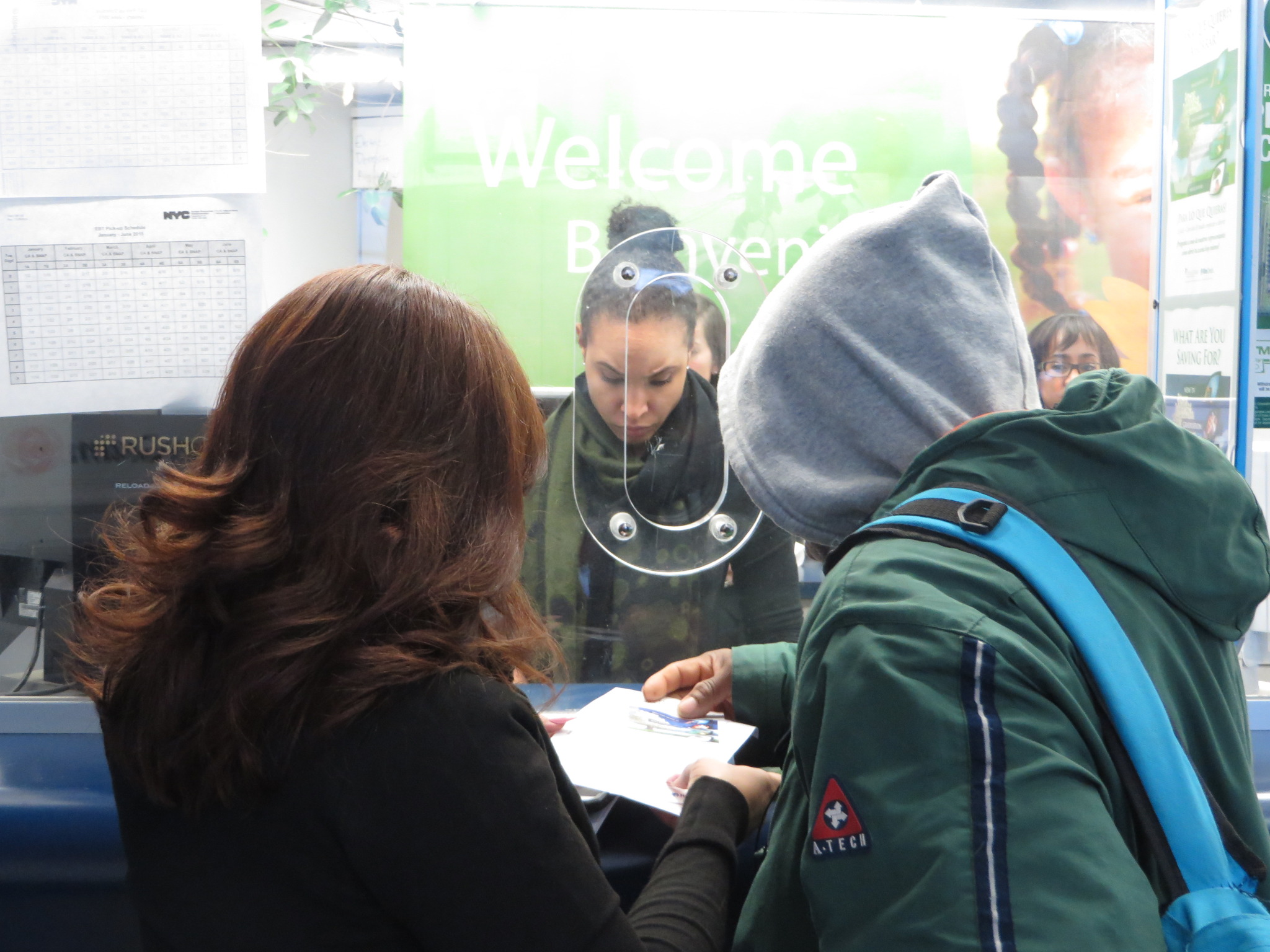

Over the past few years, IPA researchers Dean Karlan and Jonathan Zinman partnered with RiteCheck, a check casher in the Bronx and Upper Manhattan, to try just that. Working with a local credit union, IPA and RiteCheck developed simple no-fee savings account for check cashing customers. While the credit union held the account, customers could open and use the product, called Cash & Stash, at any RiteCheck branch. IPA researchers expected to see increased savings among clients who opened an account, but after one of year of marketing prompts, savings balances in the accounts didn’t significantly increase. Instead, the reminders substantively and significantly increased the number of transactions – deposits and withdrawals- that people made with their accounts. These results are a lower bound estimate, due to problems with consistent implementation of the reminders.

How, then, should researchers understand these results? After all, while these results didn’t have a statistically significant effect on balances, which would be challenging to identify changes in the data IPA collected. But, there was consistent usage of the Cash & Stash accounts in both the reminder and control groups. In this case, customer use of Cash & Stash may reflect financial well-being in a different way than was expected.

The United States Consumer Financial Protection Bureau’s (CFPB) first ever National Financial Well-Being Survey, released in September, suggests a way forward. Instead of focusing on products and providers, this survey attempts to measure the goal of financial inclusion: well-being. Financial well-being can be loosely defined as having financial security, control, and flexibility. Having reduced access to financial products often coincides with less security, and certainly with lower flexibility. If CFPB’s more holistic measures of financial well-being were applied to the RiteCheck clients in the Cash & Stash experiment, rather than simply capturing data on account balances and transactions, what would result?

At IPA, we are still working to unpack the dynamic we saw at RiteCheck, but these results suggest that when working with underserved consumers we need to think outside the box when it comes to measuring financial well-being, especially as we become more product and provider agnostic. As more and more Americans choose check-cashers over traditional banking environments due to their straightforward fee structures and transparency, the CFPB’s Financial Well-Being metrics free up advocates and entrepreneurs to think outside of the box.

Can we improve financial the well-being of underbanked Americans even without their ever stepping inside a bank, and what are the trade-offs, if any? Stay tuned for more complete analysis of our RiteCheck project results, coming in 2018.