IPA Launches $5.4 Million Initiative to Protect Digital Finance Users

The text messages start before my plane even lands in Nairobi.

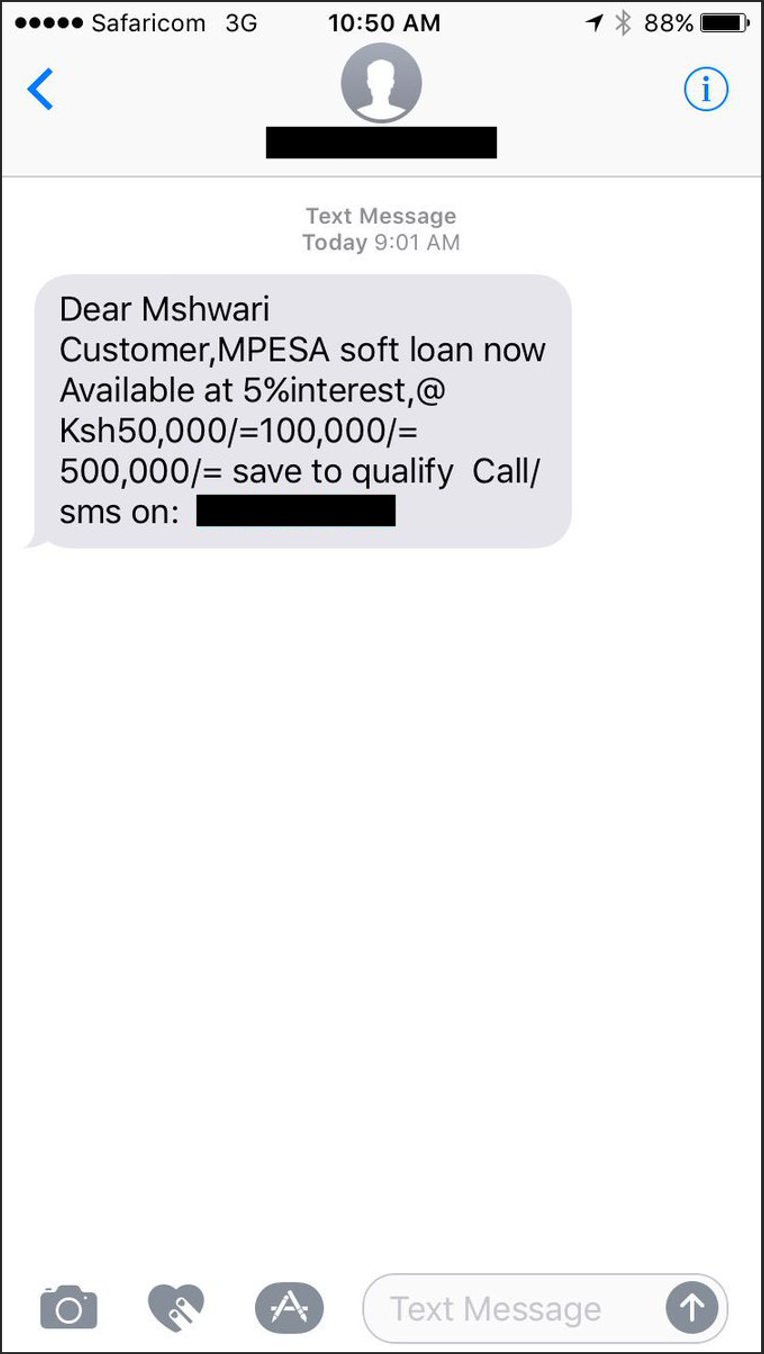

“MPESA soft loan now Available at 5% interest,@Ksh50,000. Call/sms on XXXXXXXXXX .”

My Kenyan SIM is back online, and so are the fake SMS loan offers.

I know not to reply to these messages because they don’t come from a phone number branded with a provider name, let alone the various typos I spot in most of these messages.

But many consumers don’t know the tell-tale signs of a fake loan, or maybe need a loan so bad they want to believe the offer is true. According to the 2019 FinAccess survey, 8.4% of mobile money users in Kenya report having lost funds on their mobile money accounts—and 70% of these cases were due to third-party phone or SMS fraud. And similar stories persist in countries like Uganda and Bangladesh.

Issues like fraud, lack of complaints resolution for serious cases like missing money in accounts, or lack of transparency in product terms and pricing can harm consumers, and harm financial inclusion if these experiences drive consumers to not use digital financial services.

In response to issues like these, IPA has launched a new Consumer Protection Research Initiative with Xavier Gine, Lead Economist, Development Research Group in the World Bank, serving as Academic Lead. The $5.4 million initiative––the first-ever fund for experimental consumer protection work in emerging markets––will support research to drive better consumer protection measures in digital finance, particularly in areas such as fraud, complaints handling, product information, and consumer choice.

The research initiative will work with a diverse set of providers, regulators, and civil society organizations like consumer rights group to use research to drive better consumer protection measures in areas such as fraud, complaints handling, product information and consumer choice.

The research initiative will work with a diverse set of providers, regulators, and civil society organizations like consumer rights group to use research to drive better consumer protection measures in areas such as fraud, complaints handling, product information and consumer choice.

To achieve this, IPA will be supporting two phases of research and experimentation.

The first year will focus on building new tools for market monitoring of consumer protection issues. Digital products create new sources of data on product terms, transaction data, and consumer experiences. These data sources can be invaluable tools to measure and understand the consumer protection challenges for different markets, products, and consumer segments. For this reason, we are dedicating the first year of this initiative to testing new methods for collecting and analyzing digital finance data for consumer protection.

During this phase, we plan to test a wide range of new market monitoring solutions. This could include using mobile money payments to measure consumer risk in digital credit or scraping of social media to develop consumer protection alerts sent to the regulator when there is a spike in complaints to a provider. Or behavioral research to understand why some consumers do fall for those fake loan text messages.

The second phase of the research will focus on testing solutions to consumer protection challenges through rigorous impact evaluations. But it is not enough to better document the consumer protection challenges in digital finance. We need to provide the evidence base to scale proven solutions to these challenges. Leveraging IPA’s leadership implementing randomized control trial evaluations, we will collaborate with researchers and their partners ready to test and measure consumer protection solutions. This could include testing different formats to determine the best “digital key facts statement.” Or the impact of digital channels on rural consumers’ access to government-run complaints desks that are physically located in the capital city. Or providing consumers with the ability to access and share their financial history to receive competing loan offers in real-time, creating a consumer-led, open marketplace to drive choice and competition.

But it is not enough to better document the consumer protection challenges in digital finance. We need to provide the evidence base to scale proven solutions to these challenges.

IPA has spent the past few months scouting interest and scoping problems in four priority markets that we will focus on initially: Bangladesh, Kenya, Nigeria, and Uganda. Conversations and initial data analysis make clear both the need and interest in consumer protection solutions in each of the four markets.

Researchers and others interested in participating in this exciting new research initiative should look out for the upcoming Request for Proposals in 2020.

Rafe Mazer is the Project Director of the Consumer Protection Research Initiative at IPA.