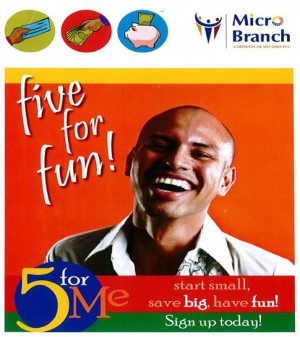

Grantee Spotlight: 5 for Fun in California

This blog series highlights the US Household Finance Initiative's Innovation Fund grantees.The fund supports the development of scalable, market-tested products that help American households make better financial decisions, escape cycles of debt, build assets, and achieve financial resiliency.

June was a big month for USHFI’s Innovation Fund partners! I was thrilled to see so many of our projects represented at the 7th Annual Underbanked Financial Services Forum in San Francisco this month. The highlight of the conference for me was the chance to watch Self-Help Federal Credit Union Vice President and Micro Branch Director Haydeé Moreno, recipient of an USHFI Innovation Fund grant, speak about how our pilot project fits into Self-Help’s work in San Jose, California.

June was a big month for USHFI’s Innovation Fund partners! I was thrilled to see so many of our projects represented at the 7th Annual Underbanked Financial Services Forum in San Francisco this month. The highlight of the conference for me was the chance to watch Self-Help Federal Credit Union Vice President and Micro Branch Director Haydeé Moreno, recipient of an USHFI Innovation Fund grant, speak about how our pilot project fits into Self-Help’s work in San Jose, California.

Micro Branch, a division of Self-Help Federal Credit Union, is a hybrid check casher and credit union branch, designed to serve unbanked families where they prefer to do business (at the check casher), while offering them a path towards mainstream financial products. Self-Help’s Micro Branch has teamed up with USHFI’s Financial Products Innovation Fund to pilot the 5 for Me Account. Using a simple commitment contract device, this account allows check cashing customers to pre-commit to transferring $5 into their savings from each check they cash. Self-Help then automates the savings behavior on the back end, so that each save is automatic and keeps the client on track to achieve their personal savings goals.

Haydeé and her team have been implementing the 5 for Me Account for two months now, and results so far look promising! Stay tuned for more on this project, as well as its sister project with New York City check casher RiteCheck (coming up in our next post!). Special thanks to Haydeé and everyone who came out to IPA’s roundtable discussion at the Underbanked Financial Services Forum – there is clearly a lot of pro-poor financial product innovation happening in the Bay Area.