Boosting Digital Financial Inclusion Through Information Campaigns in Bangladesh

Can a simple information campaign impact digital financial service usage among vulnerable cash transfer social assistance recipients in Bangladesh? Turns out, it can. An IPA study that focused on recipients of the Bangladesh Government’s social safety net allowance using informational posters, desk calendars, and videos has been shown to improve recipients’ knowledge, understanding, and usage of mobile money accounts for government-to-person (G2P) payments. These simple information campaigns when paired with improved agent service can lead to positive impacts for the recipients: their trust in mobile accounts increased by 75 percent and their ability to conduct mobile financial services (MFS) transactions improved by 40 percent.

But why is this important? Every day, digital financial services (DFS) usage continues to grow. In Bangladesh alone, mobile money account ownership of those aged 15+ increased from 2.69 percent in 2014 to 29.01 percent in 2021—and in 2021, 8.72 percent of individuals received government payments into an account. However, an increase in account ownership and usage doesn’t always translate into better financial health or effective use of accounts. Account use may be limited by potential fraud attempts and a lack of trust, awareness, and knowledge—especially within marginalized groups. Cash transfer recipients (elderly pensioners, widows and vulnerable women, and disabled) of Bangladesh Government’s social safety net allowance are a prime example of this issue.

Based on a 2022 IPA survey from the same study of the aforementioned demographic group, only 9 percent of people were able to use their financial accounts without assistance from an MFS agent. This lack of knowledge can mean two things: recipients aren’t reaping all of the benefits of their mobile wallets and they’re at risk of experiencing agent overcharging. IPA found that 7 percent of recipients paid illegal fees to agents while withdrawing their government payments. Additionally, while 42 percent of recipients have heard of MFS, 38 percent of these individuals heard this information from friends and family instead of an official and reliable source.

Empowering Marginalized Groups

With this in mind, IPA and researchers Maliha Rahanaz and Zaki Wahhaj partnered with a2i, a Bangladesh government organization focused on digitizing Bangladesh’s economy to empower the youth, rural poor, and women. We wanted to test a method through which the government could help these vulnerable populations become more aware of their mobile money accounts and safely access their social assistance benefits. To do so, we tested two approaches.

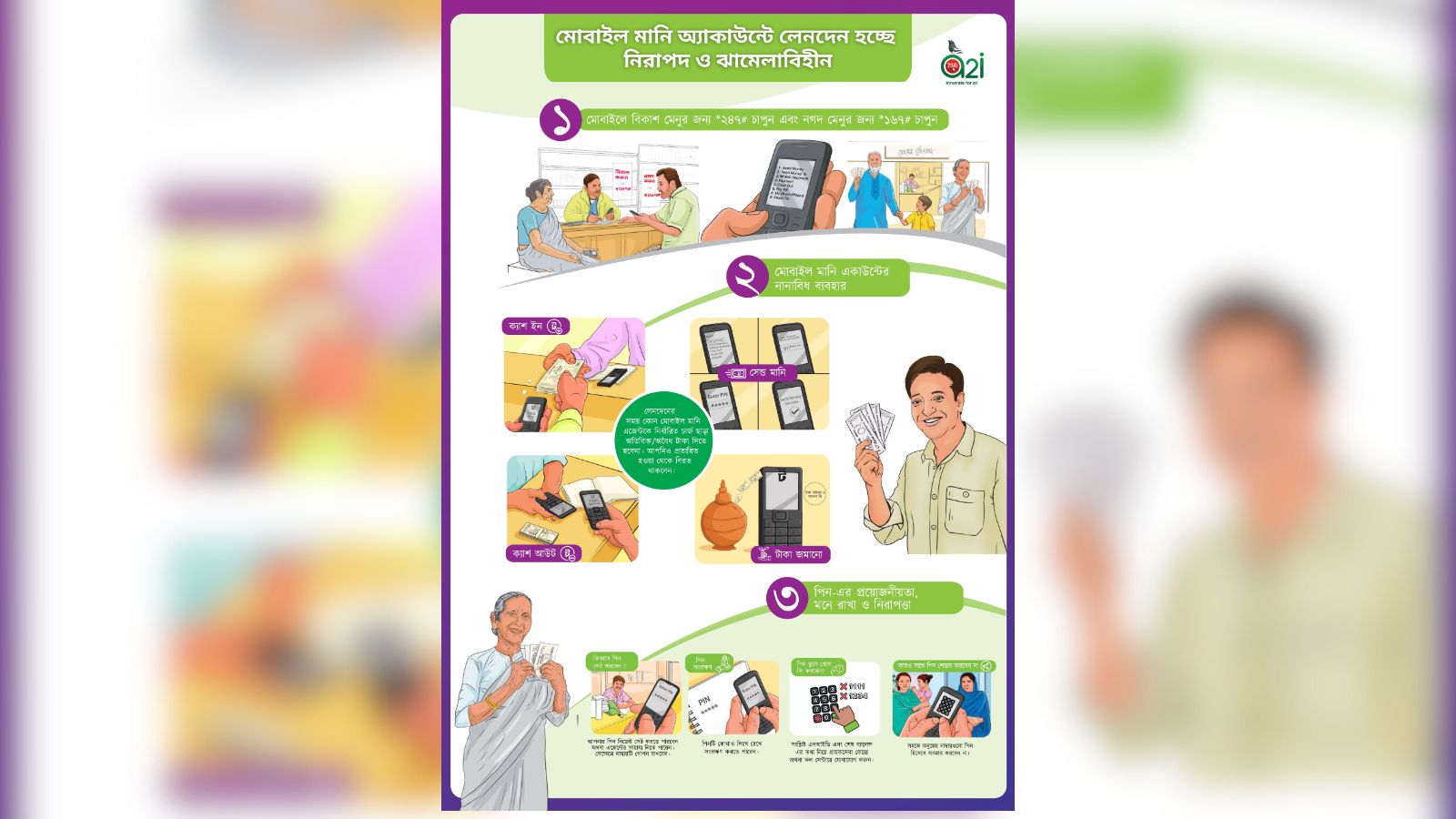

First, we produced informational posters and videos in different styles and distributed them to MFS agents—both full posters and tri-folds were also distributed to the cash transfer recipients. The information materials focused on clearly stating the various features and use of mobile money accounts and the steps to conduct transactions. We used imagery to avoid potential literacy barriers. The videos used local dialects and highlighted features of mobile money accounts, such as 1) deposits, 2) withdrawals, and 3) avoiding illegal fees charged by the agent. We distributed the informational videos to cash transfer recipients using mobile messages with links.

Second, we targeted the MFS agents using a non-monetary award scheme. We informed MFS agents that the award would recognize their role in the community and the quality of customer service. Several studies suggest motivating the agents through recognition might result in better quality of service.

The informational video about mobile money accounts was circulated among MFS agents and social assistance recipients during the project intervention in Bangladesh.

Impactful Findings

Now back to the results—overall, our initial learnings find that simple information campaigns coupled with improved service delivery can lead to positive impacts for cash transfer recipients. Here’s what we found:

1. Awareness of MFS increased by 7 to 8 percentage points among cash transfer recipients who either received the information campaign on their own or a combination of the information campaign and the agent award scheme. General awareness (i.e., from all sources) regarding MFS increased most among recipients who live in rural areas (18 percentage points) where the agent award scheme was rolled out.

2. We find detectable effects on trust (10 percentage points) in mobile money accounts when the information campaign and the agent award are combined but not for each intervention on their own. The ability to perform MFS transactions also increases (by 4 percentage points) but only among cash transfer recipients who received the information campaign. We do not see a detectable effect on this outcome when the two interventions are combined. Trust in MFS increased the most among recipients who live in rural areas (by 14 percentage points) who received both interventions.

3. The effect on trust in MFS was higher among males (12 percentage points) than females (9 percentage points), among cash transfer recipients who received both interventions.

4. There was a significant effect on self-reported savings and remittances 6 months after the study. Cash transfer recipients who were given the information campaign increased savings by 7 percentage points.

5. There was no change in cash transfer recipients’ behavior when the award scheme was implemented by itself.

This research provides policymakers, especially a2i and the Ministry of Social Welfare in Bangladesh, with insights into the state of awareness and usage of MFS accounts and the effectiveness of targeted outreach strategies. Basic information initiatives, combined with enhanced service provision, can result in favorable outcomes for recipients of G2P payments. The results also provide lessons for the private sector (such as MFS companies) on how to design products and services catering to marginalized populations. Lessons learned from this study, among others from IPA on G2P payments, can help other governments improve their efforts for digitization, creating more streamlined, scalable, and far-reaching programs.