Buy Now Pay Later: Smooth Consumption or Debt Production?

While shopping online recently, have you been asked if you would like to pay for the item later instead of right now? This offer usually is not from the company selling you a new pair of shoes, but from a third-party Buy Now, Pay Later provider (BNPLs). BNPLs allow you to make purchases immediately and pay off the cost in installments. Think of auto financing, but instead of a car, it’s a pair of Nikes, and instead of paying off over years, you pay off in weeks.

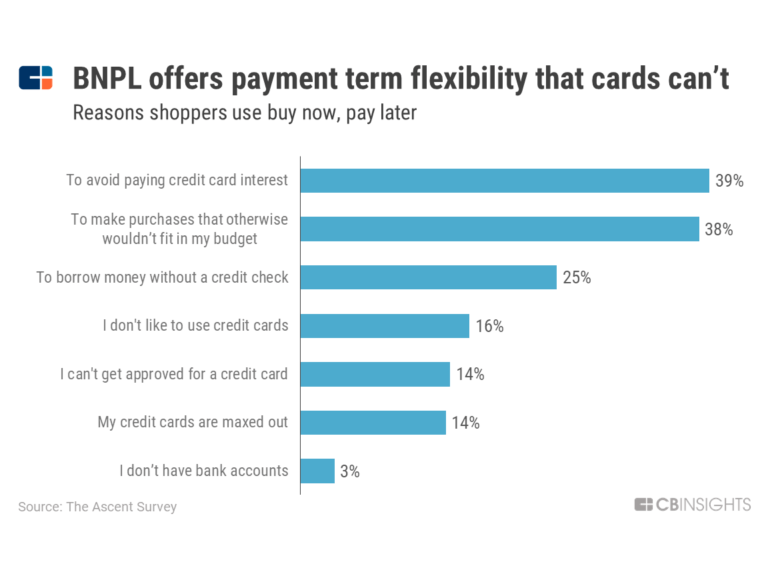

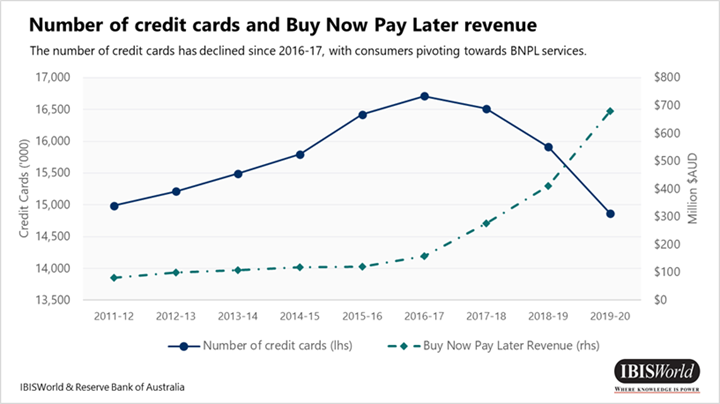

BNPLs have grown fast in recent years: in the US, one study found that 43 percent of the adult population has expressed interest in using BNPLs for large purchases. One-third of Indian survey respondents have expressed similar interests. Part of their growth is that BNPL programs offer an alternative source of financing for consumers with little to no formal credit history. This can be especially advantageous for consumers in emerging markets, where only 22 percent of adults use credit or debit cards (compared to 80 percent of adults in developed markets). This is clearly attractive for consumers, albeit primarily of younger age. But, a lack of credit lines affects adults of all ages. Low-income consumers often lack the cash on hand to purchase costly durable assets like televisions, phones, or products for their businesses. Offering lines of credit or alternative payment plans can help them buy products that improve their welfare. The slogan of one of the top BNPL companies, Klarna, is even that it “makes shopping smooth”—and the economists in our audience will recognize “smooth” from “consumption smoothing,” or the concept of making sure that people always have the ability to spend normally even during times of financial stress.

But BNPLs, like any consumer credit, have risks. These may be exacerbated by how easy it is to use these services while making online purchases. Some of these risks include, but are not limited to:

Unlike credit cards, BNPLs offer limited protections for consumers. Most countries don’t have a national agency for consumers to raise BNPL-related complaints and the existing complaints process can be very confusing.

Financially vulnerable populations may put their financial health at risk when opting for BNPLs. For instance, while lower-income Americans find BNPLs especially attractive due to financial constraints while making purchases, one in five consumers who have made a purchase using BNPLs later regretted it, according to one survey. Moreover, according to a survey by Qualtrics, 34 percent of those who have used BNPL services in the U.S. have fallen behind on one or more payments.

Since BNPLs are new, financial literacy surrounding the products is lacking. A study of younger adults found that increased financial literacy was associated with lower perceived benefits of BNPLs and higher perceived risks of BNPL arrangements. This is problematic considering the majority of BNPL users are younger consumers, which is the age group with the lowest financial literacy.

Regulators, including the US Consumer Financial Protection Bureau (CFPB), have raised several of these same concerns about BNPLs, and the United Kingdom is now trying to mitigate risks through regulation.

There is currently limited quantitative research on the welfare impacts of BNPLs. Given the fast growth of BNPL and the known risks consumer lending can raise, this may be an area where new research could help understand the benefits and risks of BNPL to form appropriate policies in the future.

Past research on consumer credit and payment plans can provide some relevant insights, which point to the types of studies researchers may want to conduct with BNPL products. These studies also show how BNPL could be both a benefit and a risk at the same time depending on the product and the context. As an example, in Uganda, Levine et al. (2018) offered payment plans to households considering purchasing fuel-efficient stoves. Consumers who had the ability to pay off the stove in installments were 20% more likely to buy the stove, suggesting that this option can have significant welfare impacts on liquidity-constrained households.

A lab experiment from Werthschulte (2020) finds that pay-later billing options have similar effects on consumption. People that pay later for their energy costs use more energy than people that have to “pay as you go.” However, Werthschulte finds that this also increases wasteful consumption of energy–meaning people are using more energy than they need, suggesting that while deferred payments can address important liquidity constraints, there is also a risk of overspending, and perhaps increased debt.

BNPL products may have the potential to improve financial access, but just like any fast-paced consumer lending product, BNPLs raise risks we need to measure and understand. For those of us conducting research in the financial inclusion community, we can begin by considering what research questions may be most important in relation to BNPL products. Some of the questions that come to mind include: How can we implement consumer protection measures within the design of BNPLs, similar to how jurisdictions have put restrictions on credit products like payday loans? Can we design and test improvements in product information or financial literacy that may improve consumers’ understanding of the terms–and risks—of BNPL? For which consumers is BNPL most successful in improving their financial health, and conversely which consumer segments are most at risk of negative outcomes when using BNPL?

What questions would you propose? Let us know your thoughts on Twitter @poverty_action with #BNPL.