Assessing the Adoption of Point-of-sale Technology by Corner Stores in Mexico

Researchers assessed the impact of the rollout of debit cards for Prospera recipients on corner stores’ adoption of point-of-sale (POS) terminals in Mexico. After two years, corner stores increased POS terminal adoption by 18 percent and increased their sales and profits by 6 percent and 19 percent, respectively. In a survey conducted with IPA Mexico in localities outside the rollout, the lack of consumers with debit cards made most corner store owners expect a lower change in profits from adopting a POS terminal than was observed.

The introduction of new payment technologies can have a profound effect on how consumers spend money, which can in turn impact businesses’ decisions to adopt card payment terminals and ultimately their sales outcomes. Between 2009 and 2012, the Mexican government disbursed about one million debit cards in 259 municipalities across the country as the new payment method for its large-scale cash transfer program, Prospera. Prior to this rollout, in the median locality, 36 percent of households had debit cards; following the influx of debit cards from the government, 54 percent of households had debit cards.1

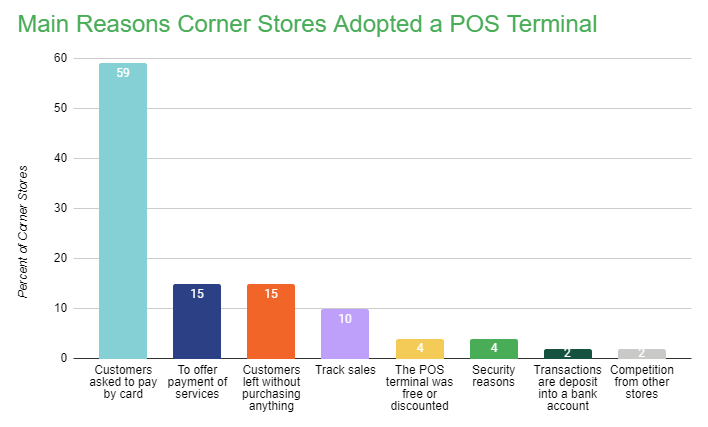

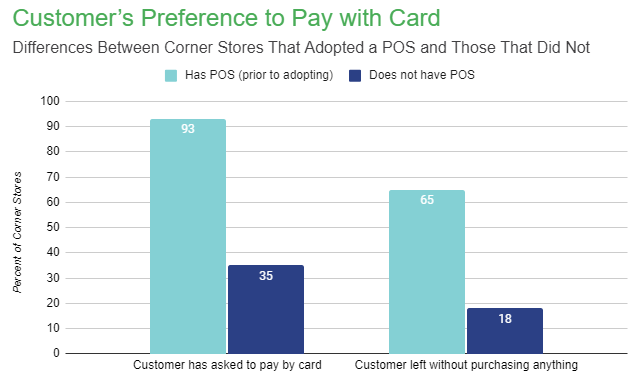

Researchers assessed the impact of the rollout of the Prospera debit cards on small retailers’ adoption of point-of-sale terminals and their sales. To do this, they collected POS terminal adoption data from the Central Bank of Mexico over 12 years, in addition to data on transactions and spending from Prospera recipients and other consumers, as well as data on sales, costs, profits, and prices from retailers. Moreover, in collaboration with IPA Mexico, researchers assessed whether the scarcity of debit cards in localities not included in the rollout contributed to low POS terminal adoption rates by corner stores. A total of 1,760 small retailers in 29 urban localities that were not included in the debit card rollout—but had similar levels of debit card and POS terminal adoption as those included had just before receiving debit cards—participated in the survey.

After two years, corner stores in early debit card rollout localities increased POS terminal adoption by 18 percent compared to those in later phase localities. In turn, other consumers (non-Prospera recipients) increased debit card adoption by 21 percent and shifted spending from large to small retailers, who increased their sales by 6 percent and profits by 19 percent.

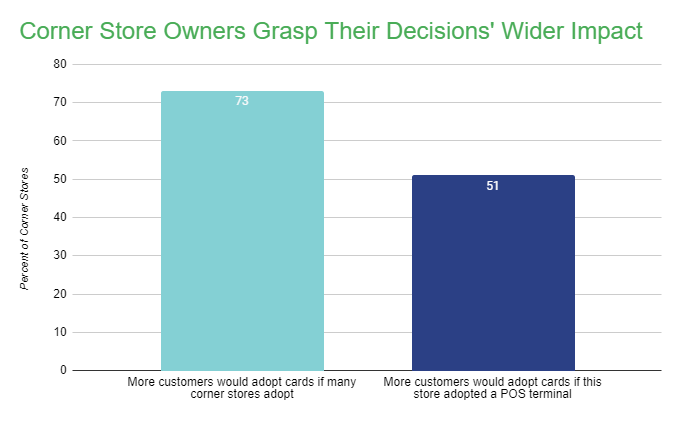

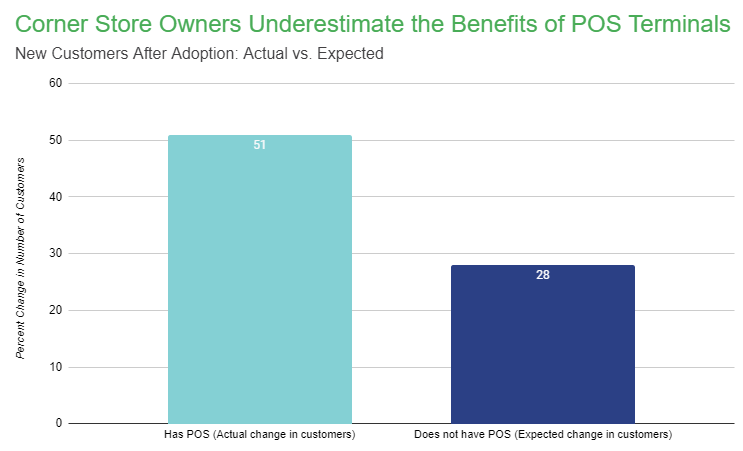

In non-rollout localities, most corner store owners expected smaller profit changes than what was observed in rollout localities. This may be because POS terminal adoption benefits increase with more consumers adopting debit cards or because owners’ expectations about them were inaccurate. Results suggest that owners underestimated the number of potential new customers who would shop at their store if they adopted POS terminals, which could widen the gap between expected and actual profit changes. This could lead to fewer corner stores adopting POS terminals than optimal even without a rollout of debit cards.

Sources

1. Higgins, Sean. "Financial Technology Adoption: Network Externalities of Cashless Payments in Mexico." American Economic Review (forthcoming).

Partners