New Consumer Protection and Competition Policies Are Needed for Kenya’s Digital Credit Market

By William Blackmon, Rafe Mazer, Ninette Mwarania, and Daniel Putman

The Central Bank of Kenya’s Banking Sector Innovation Survey indicated that in 2020 79% of all banks and 72% of all microfinance institutions had introduced new financial technology (FinTech) products to the market. Continued growth and new entrants signify a market with low barriers to entry and demonstrate the innovation opportunities available in Kenya’s financial sector. However, even with easy market entry, competition and consumer welfare concerns remain for digital credit that urgently need to be addressed to ensure consumers maximize the benefits from these products while steering clear of risks.

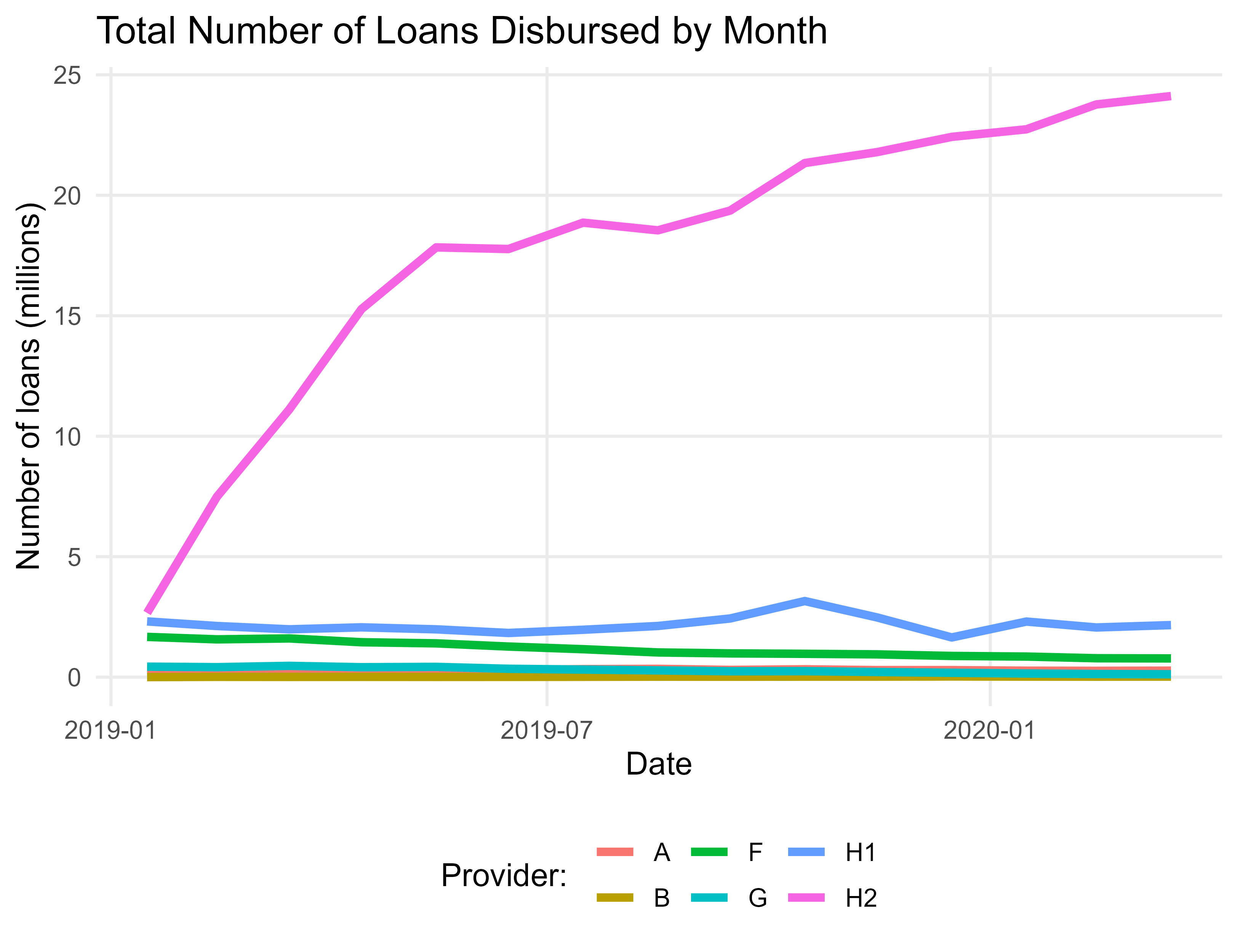

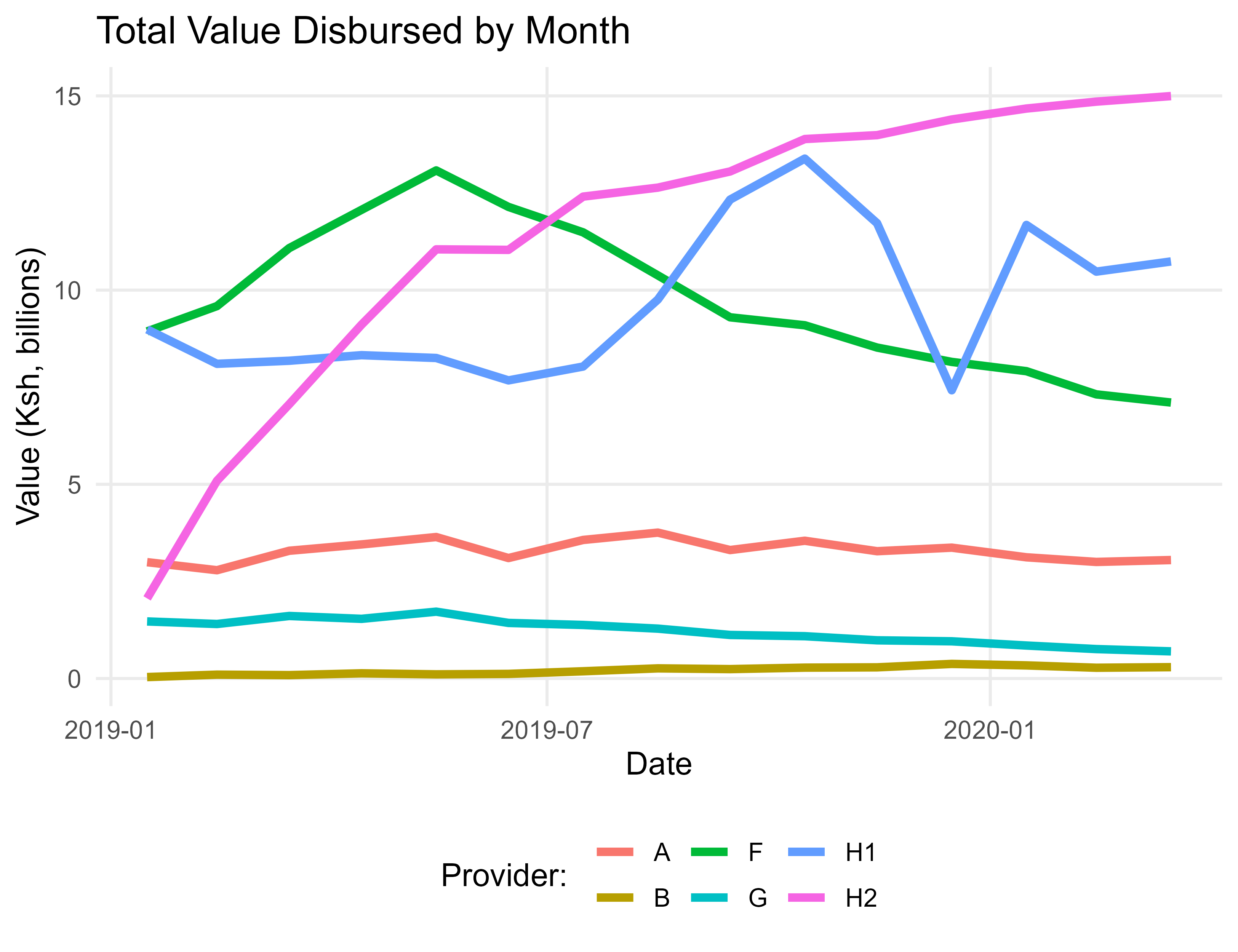

In Kenya, some of the most critical risks include the high cost of products, low consumer awareness about loan terms, and dependence by digital lenders on telecommunications/big-tech firms to access customers. When lenders partner with large firms which have established customer bases, they can quickly obtain large market shares, as shown below.

In order to better understand these challenges and other risks in the regulated and unregulated digital credit markets, the Competition Authority of Kenya (CAK) and Innovations for Poverty Action (IPA) conducted a study to identify and address potential consumer protection concerns in Kenya’s digital credit markets. The research involved a survey of 793 digital financial service users and loan data from both bank and non-bank digital lenders. The insights from this research, if considered keenly by policymakers, financial institutions, and other relevant stakeholders, could help alleviate some of the problems currently facing Kenyans using these FinTech products.

Insight 1: There is a need for modern information-sharing to drive choice and competition.

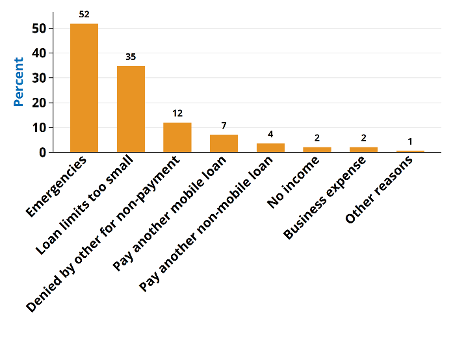

The survey found 33% of digital credit users had multiple active digital loans prior to the first reported case of COVID- on March 16, 2020. The most common reasons given for operating numerous loan accounts was that the respondents needed to attend to emergencies (52%) and that the products had low loan limits (35%) and therefore they needed to supplement.

The administrative data we collected from the lenders indicated that these types of borrowers often requested several loans in a short period. Indeed, 96% of these individuals with loans from multiple providers usually borrowed them within 30 days of each other.

It was also notable that individuals who have multiple loans from several providers were at a higher risk of defaulting on their obligations as opposed to individuals who procure multiple loans from one provider.

At present, non-bank digital lenders are not allowed to submit reports to credit reference bureaus (CRBs), and commercial banks submit reports on a monthly basis. However, our findings suggest that monthly reporting is too delayed to identify multiple borrowing behavior.

A daily reporting credit information system would help reduce lending to repeat borrowers when they already have outstanding debts with another lender. It would also allow repeat borrowers with loans from one provider to seek competing offers from new lenders who now have equal visibility with prior lenders into the borrower’s positive repayment history.

In addition, the inclusion of mobile money and historical payment data would provide valuable cash-flow information for lenders to better assess the risk profile of new borrowers and ensure that products such as mobile money overdrafts are reflected in a consumer’s credit history reports.

Insight 2. Pricing should reward good borrowers.

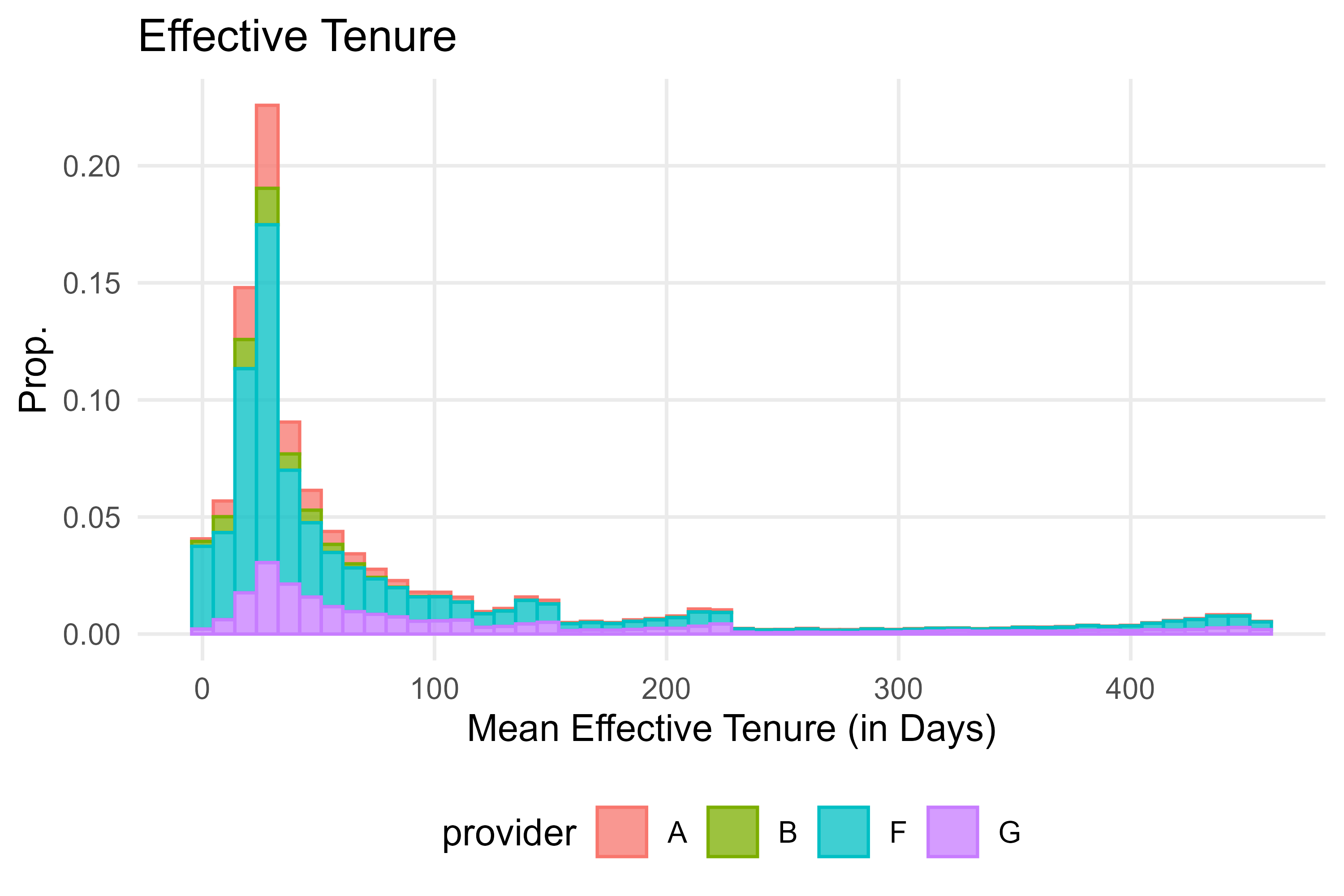

Analysis of the administrative data revealed that 4% of all borrowers in the sample fully paid their loans within 24 hours of securing them. These frequent borrowers more often than not borrow from a single lender. For example, one provider in the sample indicated that more than 50% of their borrowers applied for and received five or more loans over the 15-month sample period. Regular borrowing and prompt repayment build a strong credit history, which some lenders have begun to reward with reduced interest rates on subsequent loans. If all lenders were to refund a portion of charges to borrowers who repay before their due date and reduce the charges to repeat borrowers in good standing, the cost of borrowing would lower significantly for many frequent digital borrowers.

Insight 3: New reporting requirements will help policymaking keep pace with innovation.

To ensure digital credit policy keeps pace with product innovation, our findings suggest that several new reporting and data analysis methods could be easily built and used on an ongoing basis:

- Require reporting on fees charged and total charges to make pricing transparent. Sector regulators could collect official pricing information from providers on a monthly or semi-annual basis and publish the results. This should include not only official costs, but the actual average charges incurred by borrowers broken down by regular charges, penalties, and rollover charges.

- Develop monitoring tools to better segment at-risk consumers and measure competition. If all digital lenders were to submit account or transaction-level data to regulators, consumer protection efforts could better target the consumers who are most at risk of debt stress.

- Use customer-side data collection tools like phone surveys and complaints data for gaining periodic consumer insights. Random-digit-dial phone surveys offer a relatively fast, low-cost way to collect consumer insights that complement the transaction data recommended above. Similarly, reporting of complaints data could help identify the issues consumers raise, and how this differs across different lenders, which can be used to institute remedial measures.

The digital credit sector in Kenya continues to grow and evolve to serve the needs of households and small businesses. To ensure consumer protection keeps pace with innovation, new methods of market monitoring like those recommended by CAK and IPA in the Digital Credit Market Inquiry should become permanent features of policymaking and industry supervision.

Read the full report here.

William Blackmon is a Research Manager for IPA's Financial Inclusion Program.

Rafe Mazer is the Director of IPA's Consumer Protection Research Initiative.

Ninette Mwarania is the Manager of Planning, Policy, & Research at the Competition Authority of Kenya.

Daniel Putman is a Postdoctoral Fellow of IPA's Consumer Protection Research Initiative.