Facilitating Payments for Education in the Philippines

Abstract

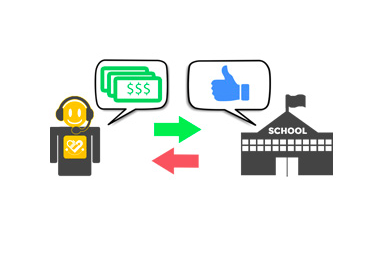

PhilSmile scaled up a financial product that enables Filipinos working abroad to send money directly to children’s schools back home.

Innovations for Poverty Action worked with researchers to investigate remittance behavior and demand for a product that allowed overseas workers to send money directly to their children’s schools in the Philippines. The lab-in-the-field-experiment found that migrants were ready to remit 15 percent more money back home when given the option to simply label some of the money as explicitly for education purposes, and being able to pay the school directly resulted in a small additional increase in the money people were ready to send home. In response to these findings, a company called PhilSmile scaled-up the product and now partners with 30 institutions in the Philippines to facilitate direct payments for education.

The Challenge

Migrant remittances are one of the largest international financial flows to developing countries. They exceeded US$400 billion in 2012, which was roughly three times the amount of total foreign aid flows to developing countries that year. Studies have shown that spending on the education of relatives back home is one of the most significant expenditures for migrant workers and that remittances improve educational attainment of migrant children. Financial products that provide migrants with greater ability to monitor and control how remittances are spent may lead them to send more money home for education.

The Evidence

Innovations for Poverty Action worked with researchers to evaluate remittance behavior and measure the demand for a product called EduPay, which allowed migrant workers in Rome to make direct payments from abroad to schools in the Philippines. Due to implementation challenges, researchers were unable to accurately measure take-up of the product, but the lab-in the-field experiment found that migrants were ready to remit 15 percent more money back home when given the option to simply label some of the money as explicitly for education purposes. Being able to pay the school directly resulted in a small additional increase in the money people were ready to send home.

The Impact

In response to these findings, an organization called PhilSmile was founded in 2014 with the purpose of scaling-up the EduPay product.1 PhilSmile started by facilitating direct payments to educational institutions by Filipinos working in Hong Kong and the United Arab Emirates (read about how it works here). As of March 2016, PhilSmile had partnered with 30 schools (including University of the Visayas, University of South Eastern Philippines, University of San Jose Recoletos) representing 150,000 students. The company has since expanded its services to domestic payments and other services.

This work is licensed under a Creative Commons Attribution 4.0 International License.