Five Ways Funders Can Support Emerging Innovations

This is a guest blog by Kate Sturla from the Global Innovation Fund. This piece is also posted on the Global Innovation Fund blog.

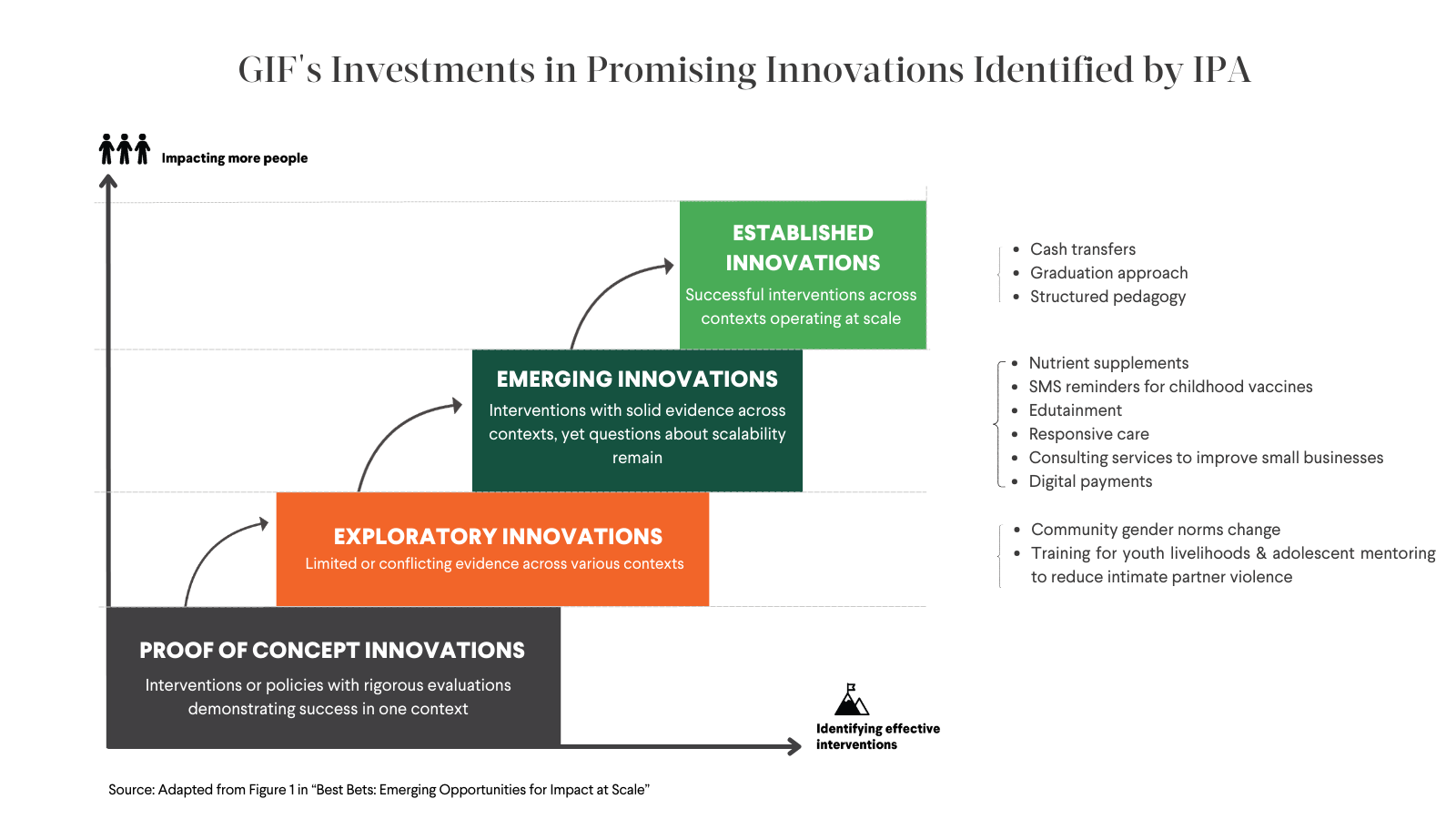

Innovations for Poverty Action (IPA’s) recent report on “Best Bets” in global development provides an excellent framework for identifying promising new innovations on the path to scale. But once found, how do we help them scale effectively?

Global Innovation Fund (GIF) finds and supports emerging innovations by placing our own “bets” on what will achieve impact and successfully scale. We were early funders of organizations pioneering innovations highlighted in the Best Bets report, such as SMS reminders for childhood vaccines, edutainment, and digital payments. Along the way, we've had big wins: investments with outsized returns in the form of positive impacts on millions of lives.

Here, we share five lessons from GIF’s nine years of experience finding and funding emerging innovations.

1. Be open to ideas from anywhere

GIF actively sources ideas from social entrepreneurs in Africa and South and Southeast Asia, but we also maintain an open application window. This expansive approach helps us find organizations with out-of-the-box ideas, such as Impact(Ed), that lie beyond our networks. Working across multiple sectors and geographies also allows us to stay open to new solutions.

2. Make funding flexible

Too often, promising ideas falter for lack of funding. We call this the “missing middle” – the relative lack of support for ideas that are past the pilot stage supported by many incubators and accelerators, but still too small to attract USAID/FCDO level grants. GIF is unique in its ability to fund both not-for-profit initiatives (via grants) as well as for-profit companies (via debt and/or equity). This flexibility allows us to prioritize the innovation regardless of where it originates, and invest in ideas that have positively impacted millions of people.

3. Apply rigor (within reason)

GIF seeks to estimate the impact of our investments as rigorously as possible while recognizing that the evidence available for new innovations is inherently incomplete. Where direct evidence is limited we draw a range of other sources, including evidence reviews from partners like IPA and data collected by our innovators. Our Practical Impact framework allows us to make informed decisions, highlight sources of uncertainty, and update our impact projections with new information.

4. Manage risks—but don't avoid them completely

Some early-stage innovations won’t work out, and that’s okay. GIF manages those risks by offering different levels of support based on the evidence available. We invest in data collection and evaluations so pilots can generate useful information even when they fail. Finally, we measure success across our whole portfolio instead of on a project-by-project basis. We’d rather have a few projects succeed spectacularly and positively impact millions of people than invest in less ambitious projects that rarely fail.

5. Plan for success

Even early-stage pilots require a plausible path to scale. For our private-sector investments, this may be plans for expanding the business to new countries and regions; for our public sector partners, this may be a government partnership. But even the best idea cannot achieve large-scale impact without a way to grow. Over the years, GIF has learned to prioritize local partners, strong communications plans and early investments in developing scaling plans.

IPA’s Best Bets report provides a framework for classifying promising innovations along the path to scale and the necessary steps to push them forward alongside key partners. GIF’s investment philosophy, honed over almost a decade of supporting early-stage innovations to scale, can provide a road map to funders for how best to support them. We encourage more funders to use these tools to take calculated risks and bet big on impact.