We Need More Data on Fast Payment Systems in Emerging Markets

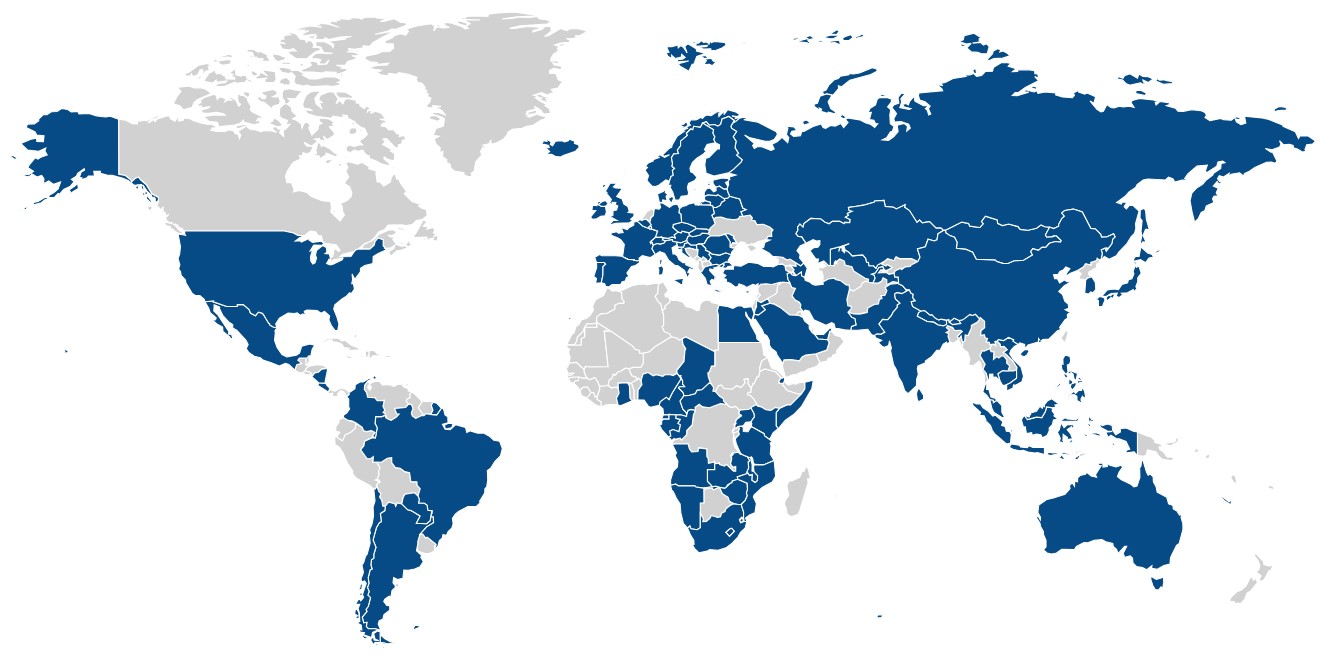

There are at least 60 fast payment systems currently operating around the world, including at least 21 in emerging markets, reaching almost 4 billion users. Most have launched in the last decade. Yet publicly available data on these systems is scarce. This lack of data inhibits evidence-based improvement and regulation of these systems.

Figure 1: Countries with fast payment systems (Source: Global Tracker | Fast Payment System 2023)

Instant and inclusive payment systems (IIPSs), a type of “fast payment system”, are interoperable payment systems with instant or near-instant transactions and inclusive design and governance. Their interoperability means that funds can easily be instantly transferred between accounts with two different financial service providers (FSPs), like banks or mobile money companies. IIPSs make it much easier to transact digitally with parties you don’t necessarily know or trust, such as merchants, because the transaction clears instantly, just like cash. These features could be particularly valuable in emerging markets, where most lower-income users don’t have access to systems that instantly clear the transactions, like credit and debit cards.

The promise of more and better data on IIPSs

In spite of the promise of IIPSs to create more efficient financial systems, remarkably little is known about a range of relevant questions such as when countries should adopt IIIPSs, the best ways to promote their use, how these systems impact financial inclusion and transition from cash to digital payments, whether these systems enhance resilience – e.g., during natural disasters and conflicts and how they should be regulated. With limited current data on IIPSs, these questions are difficult to answer. Other financial services domains produce rich data that lead to important insights; for example, transaction-level data on personal card payments in China enabled research on consumption changes during the COVID-19 pandemic and district-level ATM transaction data was used to assess the impacts of India’s 2016 demonetization (Chodorow 2019; Xu 2021). The time has come to generate – and learn from – more data on IIPSs.

Even at a national level, very few countries release data on their IIPSs

When writing a white paper on IIPSs, we found that only five out of 21 IIPSs in emerging economies had publicly available data even on national aggregates such as the number of transactions per month or the monthly volume of transactions. Making national-level IIPS data available would be a useful start toward enabling research that provides valuable insight into these systems in a number of countries.

Possibilities for even more granular data: over time, geography, and FSP

One way to provide richer data on IIPS would be to break it down over time. Mexico’s IIPS CoDi, breaks down its transactions at the daily level, as does Brazil’s Pix and India’s IIPS Unified Payments Interface (UPI). Azerbaijan and the Philippines release monthly transaction data.

No emerging economy releases IIPS data by geographic region. India’s leading digital payments provider, PhonePe, disaggregates the transactions it processes to the district level, through PhonePe Pulse, however, it doesn’t break down transactions by whether they are conducted within PhonePe’s own network or through UPI.

Another potentially informative type of disaggregation is which FSP sent and received the transaction. Mexico’s instant payment system has data broken down daily by sending and receiving banks, and the National Payments Corporation of India breaks down similar UPI data on a monthly basis for its top providers.

A combination of dimensions would also be very valuable; for example, having monthly data broken down by FSP and by region.

Sharing user-level data while maintaining privacy

Sometimes user-level data is needed to answer research questions. Releasing data at this level of granularity can raise privacy issues. However, there are established approaches to mitigate these concerns, including releasing transaction-level data without sufficient detail to identify individuals or utilizing differential privacy.

The promise of richer data

Given the potential importance of IIPSs in creating a financially inclusive economy, more data owners should prioritize making more and better data publicly available. Ideally, new IIPS implementations would be proactive about data management and public release planning at the launch of a new system. This allows decisions about what variables to measure, and how to create a robust data pipeline (from extraction to storage to the public interface), to be integrated from the beginning.

By releasing more–and more granular–disaggregated public data on their IIPSs, governments, and other stakeholders can enable researchers and policymakers to work together to devise better policies around IIPSs, based on the best evidence. Doing so would ultimately help create more efficient and inclusive financial systems.

This blog post was produced as part of a larger project studying IIPSs, the Interoperable Payment Systems project managed by the Financial Inclusion Program at Innovations for Poverty Action. This IIPS project includes a white paper on IIPSs, which includes a sample survey module on IIPSs that can be adapted for surveys on financial inclusion, and several ongoing studies on high-priority policy issues for IIPSs globally.